2025 Retail Trends That Are Changing The Game

On this page

- Are Retail Media Networks Still The Next Big Thing?

- Workforce Management (WFM) Trends For 2025

- The Physical Expansion Of DTC Brands

- Athleisure’s Astronomic Rise

- The Second-Hand Luxury Boom And The Popularity Of “Dupes”

- The Future Of Shopping Malls

- Seamless And Secure Payments Take Center Stage

- Promotions And Seasonal Spending In 2025

- The Rise Of Pet Retail Among Millennials

As we look ahead to 2025, the retail industry continues to evolve in response to economic shifts, rising consumer expectations, and technological innovations. With the National Retail Federation (NRF) annual Big Show on the horizon, we’re taking a closer look at the trends set to ‘change the game’ in line with the event’s ‘Game Changer’ theme.

These trends are rooted in strategic reinventions and recalibrations as retailers find new ways to deliver value to increasingly discerning shoppers. The following insights delve into key themes that will define the industry, including the enduring impact of retail media networks, workforce management innovations, the physical expansion of direct-to-consumer (DTC) brands, the transformation of shopping malls, and the future of promotional strategies.

NEW REPORT: US Consumer Sentiment Survey 2024

Are Retail Media Networks Still The Next Big Thing?

Retail media networks (RMNs) remain one of the most exciting opportunities in 2025, though they have transitioned from being an emerging trend to an established priority. Brands like Target and Amazon have expanded their media offerings, creating ecosystems that monetize their audience data while helping advertisers reach highly segmented shoppers. RMNs are particularly effective because they allow brands to target consumers during key purchasing moments, such as while browsing a website or app.

As these networks mature, they’re incorporating advanced AI to enhance ad personalization and measurement. Kroger, for example, continues to refine its data-driven advertising platform by leveraging predictive analytics to optimize campaign outcomes. However, as RMNs grow, brands face the challenge of standing out in increasingly crowded spaces, making creativity and relevance critical.

Workforce Management (WFM) Trends For 2025

As retailers strive to address labor challenges, workforce management is undergoing a significant transformation. Automation and AI tools are becoming essential in forecasting demand and scheduling staff accordingly, reducing inefficiencies. For example, The Vitamin Shoppe’s implementation of workforce optimization software has improved employee satisfaction and streamlined operations by aligning schedules with peak shopping hours.

Flexible scheduling and upskilling initiatives are also gaining traction. Retailers are recognizing the value of investing in their workforce to reduce turnover and improve customer service. Sephora’s continuous investment in employee training programs not only enhances team performance but also reinforces its reputation for delivering excellent in-store experiences.

READ MORE: How The Vitamin Shoppe Is Driving Payroll Efficiency

The Physical Expansion Of DTC Brands

The cost of acquiring customers through digital channels remains a pain point for many DTC brands, prompting them to double down on physical stores. This trend continues in 2025 as brands like Warby Parker and Glossier expand their brick-and-mortar presence to foster deeper customer connections. Physical spaces allow these brands to showcase their unique identities, create interactive experiences, and build trust with consumers.

For example, Allbirds, known for its eco-friendly footwear, has expanded its retail footprint significantly, emphasizing sustainable store designs and localized community events. Such initiatives enable DTC brands to diversify their acquisition strategies while offsetting the escalating costs of digital marketing.

Athleisure’s Astronomic Rise

Athleisure is no longer a passing trend—it’s a cornerstone of modern wardrobes, and 2025 sees this category thriving like never before. Brands such as Lululemon and Nike are capitalizing on this trend by releasing apparel that seamlessly blends performance and style, catering to both fitness enthusiasts and those seeking comfortable, versatile clothing.

What’s fueling this growth is a broader cultural shift toward wellness and hybrid lifestyles. With more people balancing work-from-home days with gym visits and errands, the demand for clothing that adapts to multiple settings has surged. Partnerships, like Adidas’ collaboration with Gucci, show how athleisure has infiltrated even the luxury market, blurring the lines between casual and high-end fashion.

The Second-Hand Luxury Boom And The Popularity Of “Dupes”

Sustainability and affordability are two of the most significant drivers shaping consumer behavior in 2025. Second-hand luxury, a category already experiencing rapid growth, is expected to soar further this year. Platforms like Vestiaire Collective and The RealReal have normalized the resale of high-end goods, making luxury more accessible while promoting a circular economy.

On the other end of the spectrum, the popularity of “dupes”—affordable, ‘duplicate’ versions of luxury items—continues to rise. TikTok trends featuring affordable alternatives to designer bags or skincare products have amplified this phenomenon. While some luxury brands are wary of how dupes might erode exclusivity, others see an opportunity to innovate, with brands like Dior and Prada experimenting with “entry-level” luxury products to attract younger audiences.

READ MORE: Tracking The Evolution Of Luxury Retail

The Future Of Shopping Malls

To remain relevant in 2025, malls are embracing mixed-use developments and community-oriented experiences. Traditional malls are evolving into lifestyle hubs, incorporating entertainment, coworking spaces, residential units, and fitness centers to attract foot traffic. The American Dream mall in New Jersey exemplifies this trend by blending retail with attractions like indoor skiing and amusement parks.

Retailers within these spaces are also rethinking their approach. Pop-up stores and experiential retail have become central to attracting younger shoppers who value unique and engaging experiences over traditional browsing. For malls to succeed, they must cater to this demand for novelty and connection.

Seamless And Secure Payments Take Center Stage

In an era of increasing digital sophistication, payments are becoming more seamless and secure, ensuring frictionless transactions for shoppers. Biometric payment methods, such as Amazon One’s palm-scanning technology, are gaining traction as consumers prioritize speed and security.

Retailers are also embracing “invisible payments,” where transactions happen automatically without requiring active customer input, similar to Amazon Go’s checkout-free stores. These innovations not only enhance convenience but also reduce checkout times, creating a more satisfying shopping experience. Furthermore, with cybersecurity concerns on the rise, retailers are investing in encryption technologies and fraud detection tools to build trust and protect customer data.

Buy now, pay later (BNPL) services like Klarna are also gaining momentum in this space. Most recently, Klarna announced that it would be launching on Google Pay, making interest-free payment options at checkout even more convenient.

Promotions And Seasonal Spending In 2025

As consumers navigate economic uncertainty, discounts and promotional strategies will play a pivotal role in 2025. Retailers are likely to offer deeper discounts during peak seasons, leveraging data analytics to tailor promotions to specific customer segments. This approach ensures that markdowns drive maximum impact without eroding profitability.

For instance, Valentine’s Day and Easter are expected to see steady investment from shoppers, particularly in categories like confectionery and dining. However, the focus on sustainability influences buying behavior. Retailers such as Lush and Patagonia are projected to lean into eco-friendly holiday campaigns, emphasizing gifts that are not only meaningful but also environmentally conscious.

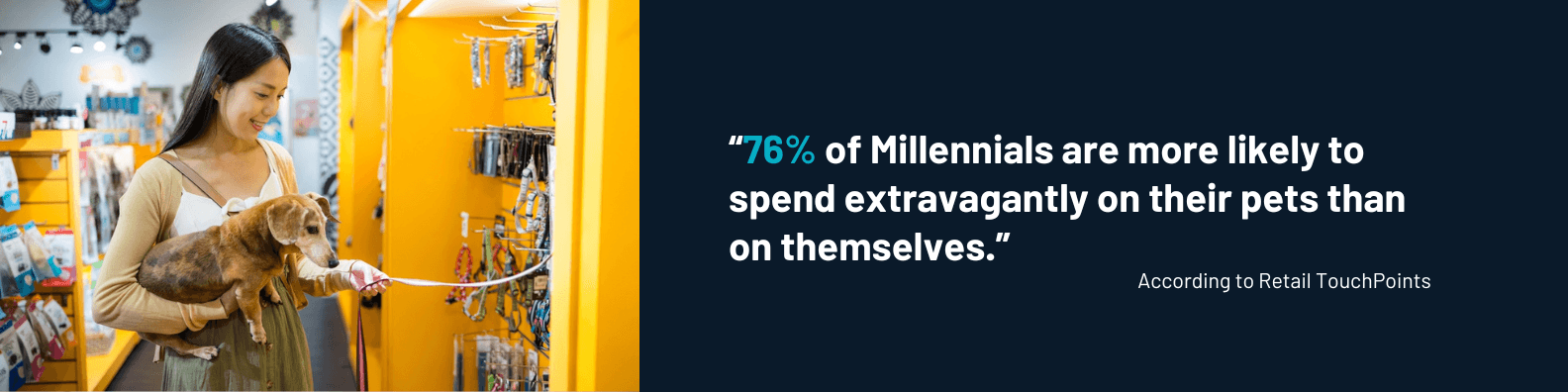

The Rise Of Pet Retail Among Millennials

Pet retail is experiencing a boom in 2025, driven largely by millennial pet owners who treat their furry companions as family members. With millennials making up the largest segment of pet owners, spending on premium pet products and services has skyrocketed. Brands like Chewy and Petco are capitalizing on this trend by offering subscription boxes, personalized nutrition plans, and even wellness services for pets.

Meanwhile, luxury retailers are entering the space, with companies like Gucci and Versace launching pet accessory lines that appeal to this demographic’s penchant for high-end products. The rise of “petfluencers” on social media further amplifies this trend, as pet owners are inspired to invest in everything from stylish outfits to gourmet treats for their animals. This growing sector underscores how emotional connections with pets are shaping retail, creating opportunities for innovation and niche markets.

The trajectory for 2025 retail strikes a balance between tradition and innovation. Retailers that adapt to these trends while staying attuned to consumer needs are poised to thrive in 2025 and beyond.

LET’S GRAB COFFEE: Chat With Us At The NRF ‘25 Big Show

About the author:

Ashton Kirsten, Global Brand Manager, RetailNext

Ashton holds a Master's Degree in English and is passionate about physical retail's unbridled potential to excite, entertain, serve, and solve problems for today's shoppers.