Black Friday 2025: US Retail Traffic And Sales Performance

On this page

The narrative around Black Friday 2025 began with headlines about declining foot traffic, but the full story reveals something more nuanced: a retail landscape in which shoppers have become more strategic, selective, and sophisticated in their holiday shopping. As RetailNext's comprehensive traffic and sales data from tens of thousands of US stores shows, this year marked not the decline of physical retail, but its evolution.

CONNECT 👉 RetailNext's NRF '26 Big Show: Innovation. Agility. Impact.

Traffic Patterns Reflect Intentional Shopping

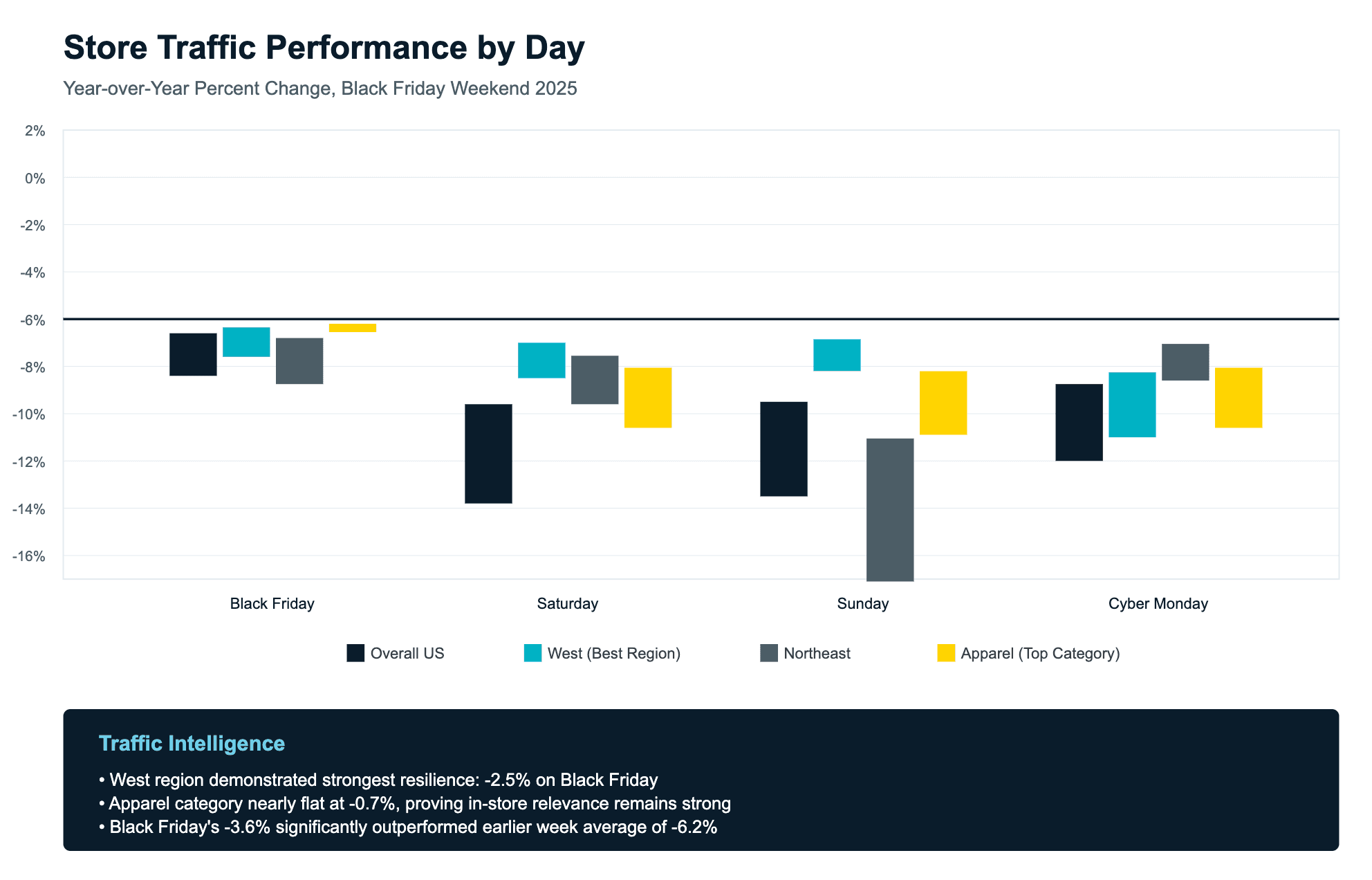

According to RetailNext's traffic insights platform, overall US store traffic declined 3.6% on Black Friday compared to 2024, with the full Friday-through-Monday period showing a 5.8% decrease. Yet context matters enormously here. Black Friday still delivered the highest in-store traffic of any day in 2025, proving its continued relevance as the anchor of the holiday shopping season.

"Black Friday 2025 didn't kill the holiday; it changed how shoppers approached it," notes Joe Shasteen, Global Head of Advanced Analytics at RetailNext. "Foot traffic was down 3.6% on Friday and 8.6% on Saturday, but that wasn't disinterest, it was intention. Shoppers showed they're done with the impulse-driven, one-day frenzy."

The regional variations tell their own compelling story. While the West showed remarkable resilience with only a 2.5% decline on Black Friday and 3.0% for the full weekend, the Midwest faced extraordinary challenges. A powerful snowstorm sent Saturday traffic in that region plummeting by 41.8%, demonstrating how weather volatility now creates immediate, measurable impacts on brick-and-mortar performance. Strip out this weather anomaly, and the national picture improves considerably.

Sales Data Reveals Strategic Consumer Behavior

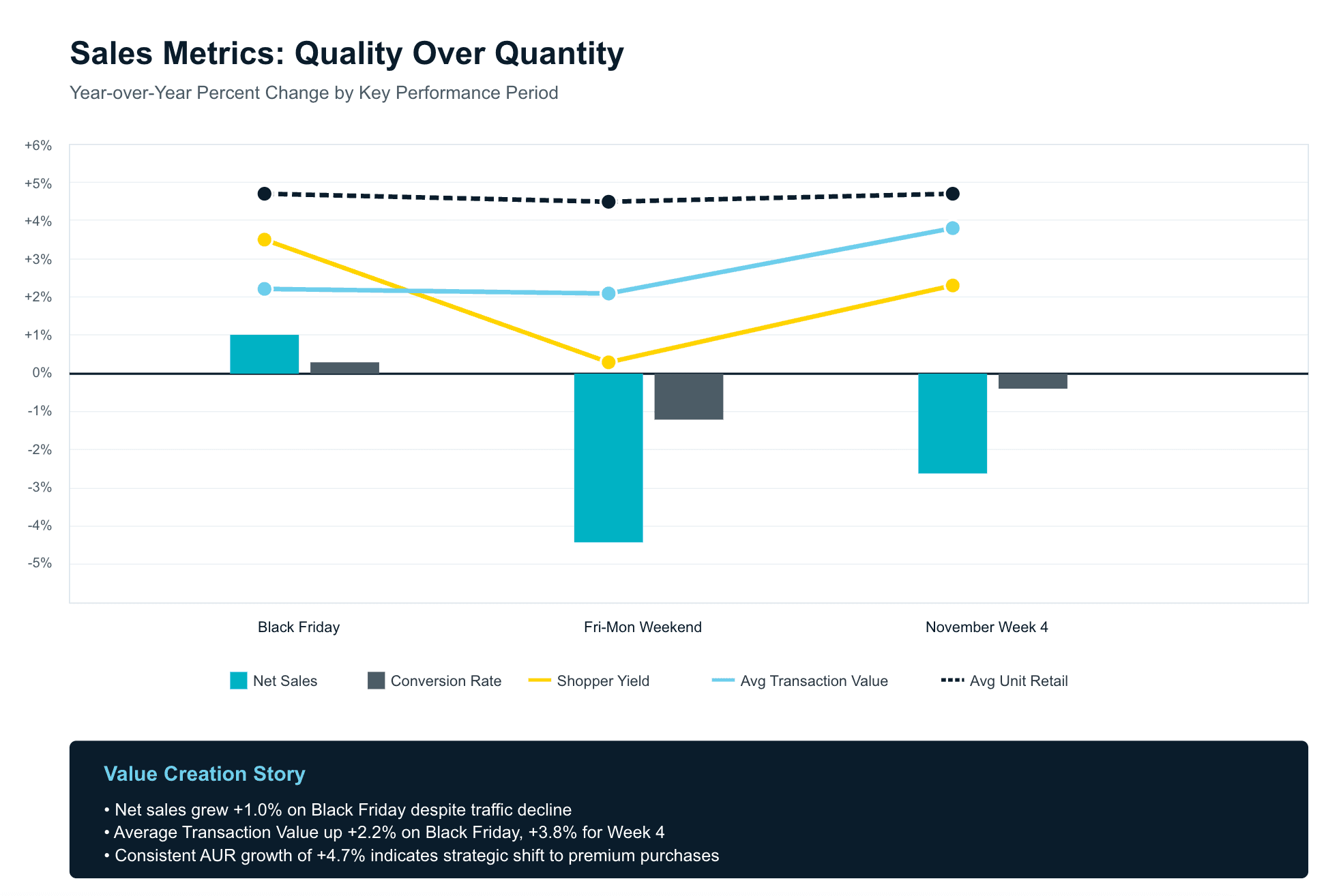

Perhaps the most encouraging aspect of Black Friday 2025 lies not in the traffic numbers but in what shoppers actually did once they entered stores. Net sales increased 1.0% on Black Friday itself, despite the traffic decline, indicating that those who visited stores came with clear purchasing intent.

The real winner was Average Transaction Value (ATV), which climbed 2.2% on Black Friday and maintained strength throughout the weekend at 2.1% for the Friday-Monday period. This uplift, combined with a robust 4.7% increase in Average Unit Retail (AUR) across all measured periods, paints a picture of consumers who are trading up when they do shop, focusing on quality over quantity.

Shopper Yield, measuring sales per visitor, jumped an impressive 3.5% on Black Friday. This metric crystallizes the shift: fewer browsers, more buyers. Retailers who understood this dynamic and created compelling reasons for store visits saw stronger performance.

The slight decline in Units Per Transaction (down 1.3% on Black Friday) alongside rising AUR suggests consumers are buying fewer but higher-value items. This isn't the behavior of shoppers in retreat; it's the pattern of strategic purchasers making considered decisions.

Category Performance Mirrors Consumer Priorities

Category-level data from RetailNext's analytics reveals how households are prioritizing their spending. Apparel showed remarkable strength with only a 0.7% traffic decline on Black Friday, nearly flat compared to last year. This resilience in clothing purchases, even as overall traffic declined, suggests consumers still see value in experiencing fashion products in person before purchasing.

The steeper declines in categories like Home (down 10.3% for the whole weekend) and Footwear (down 6.8%) reflect the discretionary pullback in big-ticket and nice-to-have categories. Health & Beauty's 5.4% weekend decline and Jewelry's 4.3% drop further illustrate where consumers are drawing spending boundaries.

Yet even these challenged categories saw improved sales metrics. The combination of higher ATV and AUR across categories indicates that when shoppers did engage with these segments, they purchased with conviction.

Global Context And The Digital Factor

The US experience wasn't unique. UK shoppers spent $5.0 billion online across the Black Friday to Cyber Monday period, up 4.6% year-over-year, according to Adobe Analytics, while maintaining similar strategic purchasing patterns. The parallel trends across markets suggest a global shift in shopping behavior rather than isolated national phenomena.

In the US, online sales hit record levels with Black Friday generating $11.8 billion in e-commerce spending, up significantly from 2024. Cyber Monday continued this momentum with $14.25 billion in online sales. The strength of digital channels alongside resilient in-store sales performance demonstrates that omnichannel retail, not pure e-commerce, represents the future.

What's particularly telling is that Buy Now, Pay Later drove over $1 billion in online spending on Cyber Monday alone, highlighting how payment flexibility has become essential to maintaining consumer engagement during challenging economic times.

Understanding The Underlying Forces

Several converging factors shaped this year's performance. Rising costs for essentials like rent, food, and utilities forced households into starker spending trade-offs. Modest tariff increases earlier in 2025 pushed up prices in key categories, particularly affecting the very segments that saw traffic declines.

Retailers themselves contributed to the shift by training consumers to expect month-long promotional periods rather than single-day events. Shoppers responded by spreading their purchasing across November, attending only those promotional events they deemed worth the trip. The 3.6% Black Friday decline was actually meaningfully better than the 6.2% decline seen earlier in the week, proving shoppers still respond to compelling events.

"Consumers are still willing to shop, they're just demanding proof it's worth leaving the house," Shasteen observed. "Retailers who treated November as a month-long build, rather than a single-day spectacle, saw the strongest in-store performance."

The Path Forward

Black Friday 2025 marks an inflection point, not an endpoint, for physical retail. The combination of positive sales growth despite traffic declines, higher transaction values, and improved shopper yield metrics reveals a sector adapting successfully to changing consumer behaviors.

The data suggests several opportunities for retailers moving forward. First, the premium on each store visit has never been higher. With Shopper Yield up significantly, every visitor represents greater potential value. Retailers must ensure their in-store experiences justify the trip through superior service, exclusive products, or experiences that can't be replicated online.

Second, the rise in AUR indicates consumers are willing to invest in quality when given compelling reasons. This presents opportunities for retailers to elevate their product mix and storytelling around value beyond price.

Third, the category performance variations highlight the importance of understanding specific consumer mindsets by segment. Apparel's resilience suggests certain categories maintain inherent advantages in physical retail that smart retailers can amplify.

Looking ahead, retailers who recognize that we've entered an era of intentional shopping rather than recreational browsing will thrive. The consumers haven't disappeared; they've evolved. They're shopping across channels, demanding value, and rewarding retailers who respect their time and intelligence.

Physical retail's resilience in 2025, delivering noteworthy traffic despite headwinds and maintaining sales growth in a challenged environment, proves that stores remain essential to the commerce ecosystem. The successful retailers of 2026 and beyond will be those who understand that every square foot of retail space must earn its keep, every associate interaction must add value, and every promotion must solve a real consumer need.

Black Friday 2025 demonstrated that the future of retail is about excellence in both offline and online shopping, wrapped in experiences that make each channel indispensable. For retailers armed with the right analytics and insights, the opportunity has never been clearer.

YOUR NEXT READ 👉Boggi Milano: How Analytics Drove 40% Shopper Yield Growth

About the author:

Ashton Kirsten, Global Brand Manager, RetailNext

Ashton holds a Master's Degree in English and is passionate about physical retail's unbridled potential to excite, entertain, serve, and solve problems for today's shoppers.