Black Friday Weekend Data: What To Expect For The Holidays

Retailers outperformed expectations over the 2022 Black Friday weekend, despite consumers’ projected spendthriftness amid the pangs of inflation, supply chain concerns, and lingering economic instability due to the COVID pandemic. The high-volume sales period saw a notable uptick in foot traffic in-store as well as record-breaking online sales. Here’s what you need to know now.

Overall US Store Traffic (2022 vs 2021):

Friday, 25 Nov - Sunday, 27 Nov (Black Friday Weekend): 2.5%

Monday, 28 Nov (Cyber Monday): -4.1%

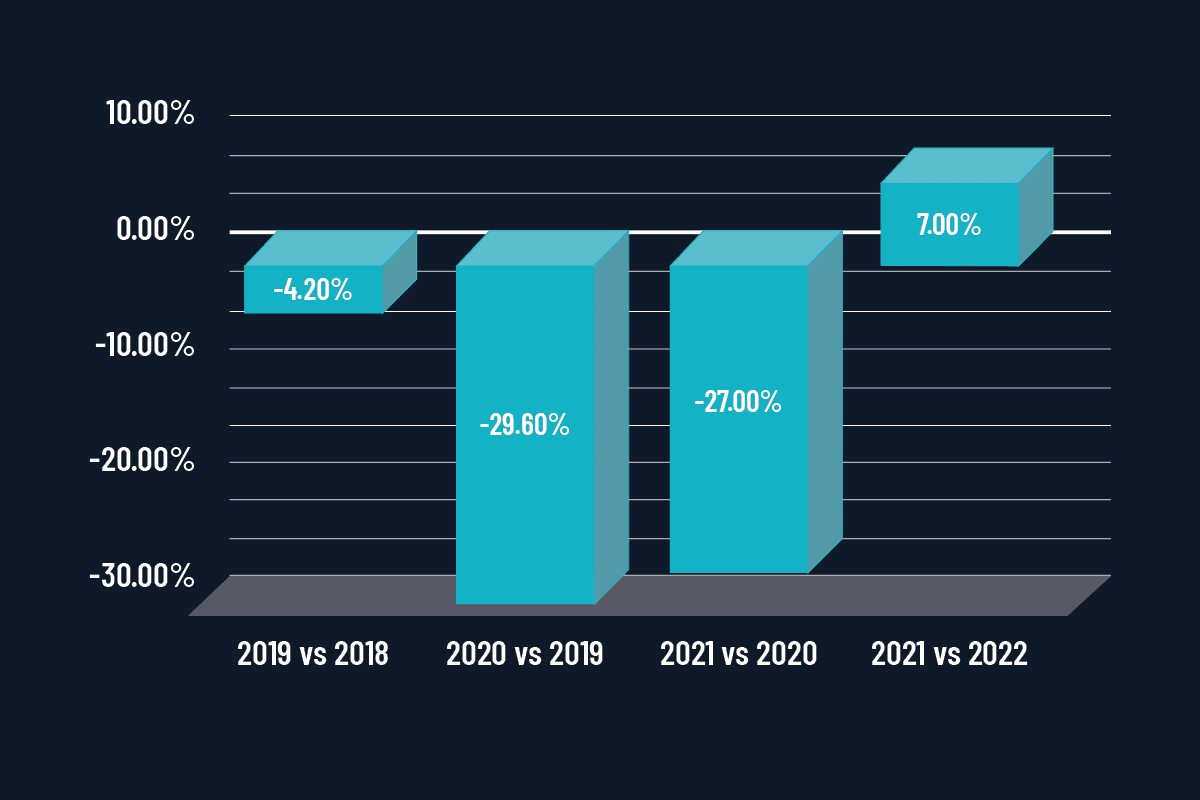

Black Friday Weekend Traffic Gains And Losses Year-on-Year (2019-2022):

Overall US Store Sales (2022 vs 2021):

Friday, 25 Nov - Sunday, 27 Nov

Sales: -3.1%

ATV: 1.4%

CVR: -1.0%

SY: -5.0%

UPT: -1.5%

AUR: 5.9%

Cyber Monday: Monday, 28 Nov

Sales: -9.3%

ATV: -3.8%

CVR: -0.3%

SY: -4.8%

UPT: -8.3%

AUR: 4.3%

At A Glance: 2022 Black Friday Weekend Traffic Trends

Physical store traffic rose an impressive 7% on Black Friday over last year as brick-and-mortar. While there are still significant challenges in the retail industry, the increase in Black Friday foot traffic is quite encouraging as more shoppers continue to go back into stores with a desire to browse.

Analysts have characterized this holiday season as anything but typical, but the data paints a picture of promising growth. For the period of Sunday through Thursday leading up to Black Friday, 2022 traffic was down just 1.1% compared to the same period in 2021.

U.S. Store Traffic per Day (2022 vs 2021)

Friday, 25 Nov (Black Friday): +7%

Saturday, 26 Nov: +0.6%

Sunday, Nov 27: -2.8%

Friday, 25 Nov - Sunday, 27 Nov (Black Friday Weekend): 2.5%

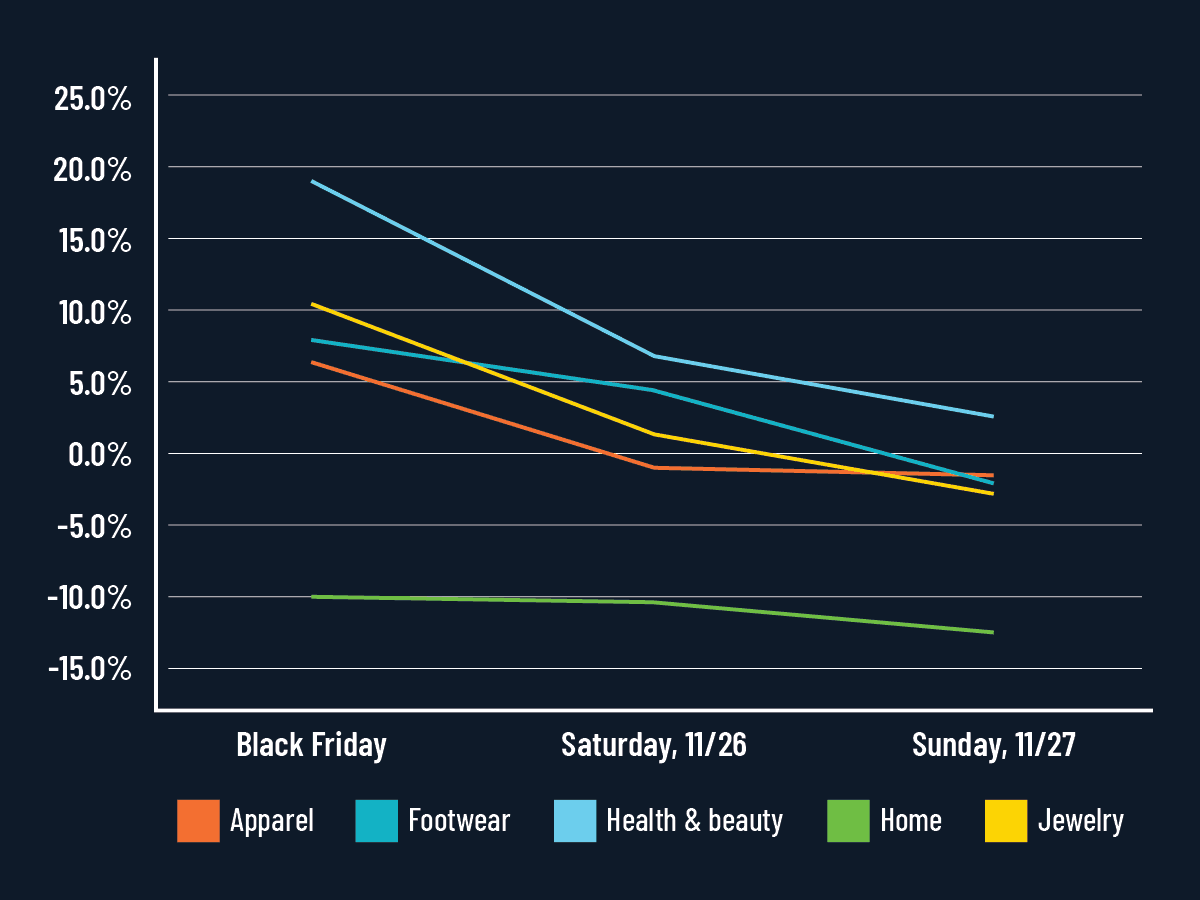

US Store Traffic per Category (2022 vs 2021)

Apparel: +2.2%

Footwear: +3.5%

Health & Beauty: +12.3%

Home: -11.0%

Jewelry: +4.8%

Daily US Store Traffic per Category (2022 vs 2021)

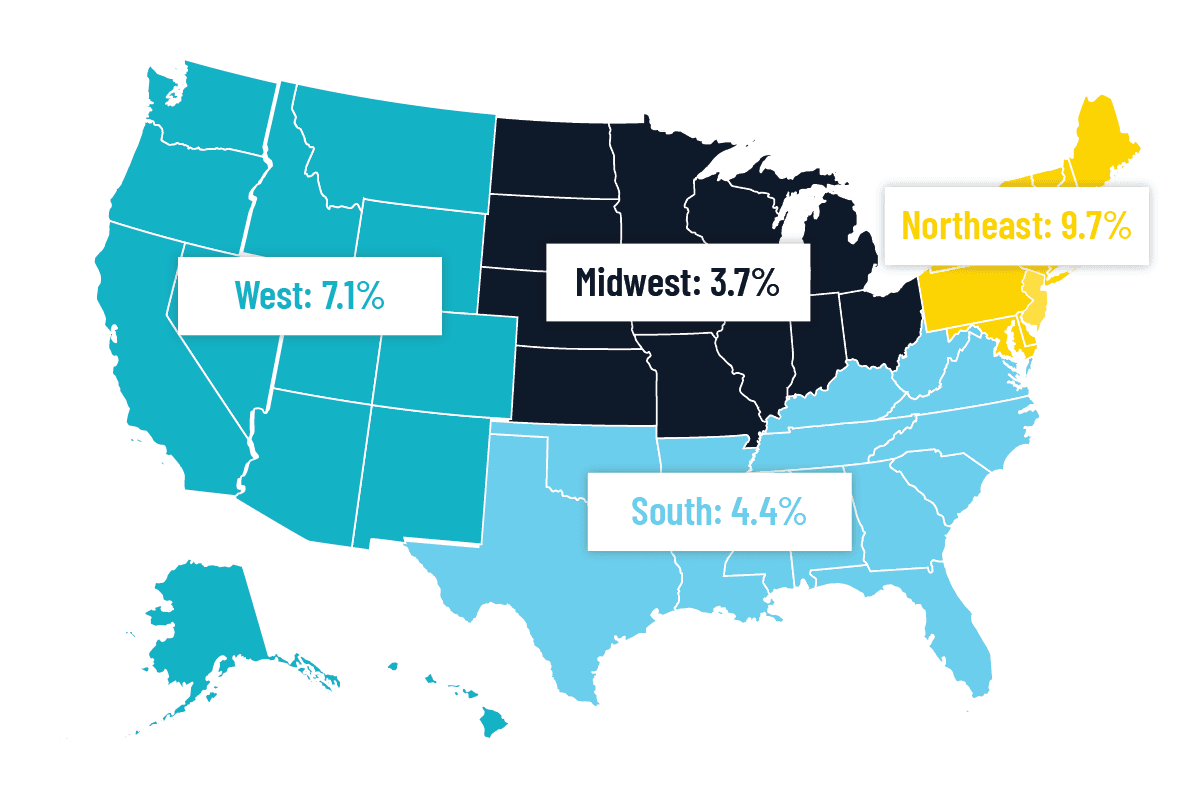

From a regional outlook, the Northeast US saw the biggest spike in store traffic, with the Midwest seeing the smallest increase.

Cyber Monday, Summarized

Despite the positive traffic trends noted over the Black Friday weekend, Cyber Monday proved to be less popular in-store with a 4.1% decline in-store traffic.

US Store Traffic per Category on Cyber Monday (2022 vs 2021):

Apparel: -2.6%

Footwear: -2.8%

Health & Beauty: -1.1%

Home: -11.5%

Jewelry: -2.7%

But while consumers took advantage of more online deals this year, they’re also heading to stores to pick up packages, check out products in person, and snap up deals that often rival those available online.

Moreover, Adobe expects curbside pickup to peak right before Christmas Eve, and this spike is projected to account for the fulfillment of as much as 35% of all online orders. And therein lies the opportunity for retailers that invest in hybrid strategies that leverage both digital and in-person experiences.

How Retailers Can Stay Ahead This Holiday Season

Retailers will need to adapt to the uncertainty around this festive season. And discounts won’t be enough. That's why future-forward retailers are relying on a data-driven approach that enable them to flexibly optimize the in-store experience and gives frontline teams the agility needed to deliver excellence during what promises to be an especially chaotic holiday season.

1. Optimizing staff scheduling. Persistent and widespread labor shortages are likely to continue into the holidays and beyond, placing a strain on retailers that typically increase staffing during the peak season. One solution: using in-store traffic data to illuminate shopper behavior patterns and inform workforce management processes. With the right tools, retailers are able to accurately forecast peak shopping hours and use that analysis to schedule store associates more efficiently. Effective staffing reduces wait times and increases customer satisfaction. It also enables managers to staff up during periods when conversion rates are highest, maximizing revenues over time.

2. Streamlining fulfillment and returns. Supply chain volatility is still with us and isn’t likely to improve as we head into the busy holiday season. Consumers say that persistent delays are enough to make them abandon a brand. So, retailers need to use all the tools at their disposal to streamline the customer experience. With the right traffic data, retailers optimize staffing to ensure customers get the support they need when making a purchase, increasing satisfaction and reducing the need for returns. This also makes it easier to manage offerings such as BOPIS and BOPAC, connecting logistics, traffic, and workforce data to create more accurate forecasts that directly improve the customer experience.

3. Prioritizing performance. Data is a powerful tool, but only if it is part of the in-store culture. Brands that are empowering stores to improve performance by providing both managers and frontline teams with access to key performance metrics are able to adapt and improve. For example, by integrating traffic data with in-store POS feeds and staffing data, corporate teams give store managers more timely feedback benchmarked against brand goals and peer stores. Seeing performance indicators in real-time motivate stores to experiment, evolve, and correct inefficiencies throughout the season.

4. Creating exceptional experiences. Brands are accustomed to offering big discounts during holiday-season promotions, but customers increasingly care about the in-store experience too. Granular traffic data, capture rate analytics, and other forms of retail intelligence highlight which campaigns are working well, spot friction points that could diminish the customer experience, and ensure compliance with promotions and other in-store processes — including sustainability practices, which customers increasingly care deeply about.

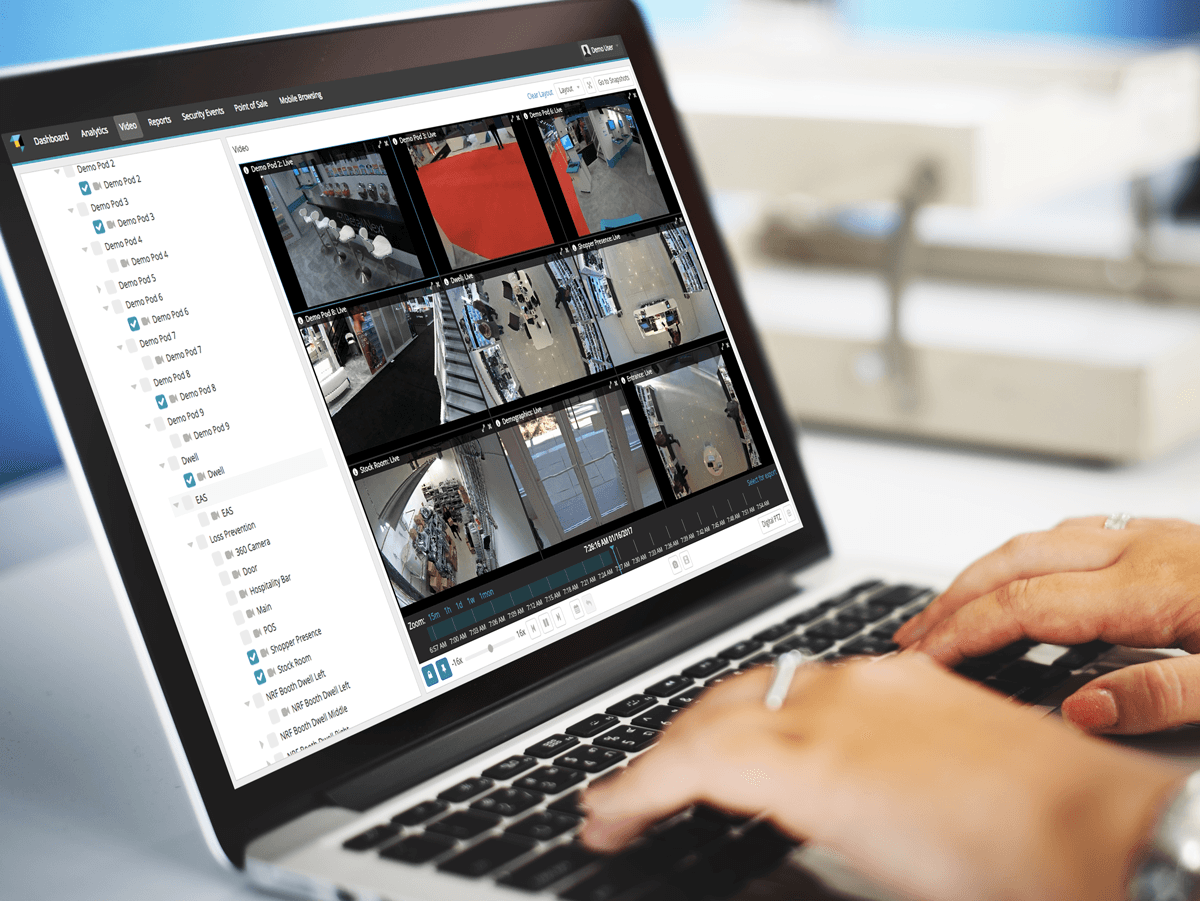

5. Stepping up security. Asset protection is a must during the holiday season, and with more customers being served by fewer in-store associates, retailers are leveling up their technology. Smart cameras and AI analytics can help to detect theft and fraud more quickly, minimizing losses without impeding the customer experience, and enabling teams to keep holiday-season shrinkage to a minimum. This should then yield bottom-line benefits that can then be reinvested to further improve the retail experience.

Interested in learning more about how in-store analytics drives brand performance?

Then let's connect over coffee at NRF 2023 in NYC! ☕️

About the author:

Ashton Kirsten, Global Brand Manager, RetailNext

Ashton holds a Master's Degree in English and is passionate about physical retail's unbridled potential to excite, entertain, serve, and solve problems for today's shoppers.