How COVID-19 Created the Store of the Future

On this page

For years retailers have been talking about the store of the future, how to compete with Amazon, and how to best serve today's digitally driven customer. The pace has been maddeningly slow - both as an executive in retail technology and as a consumer. Yes, some of the lowest hanging fruit has been picked - you can now return online purchases in-store (remember when that was a thing, having to return online purchases through the mail?), and pricing disparities have largely been solved. Beyond the obvious, however, retailers have largely resisted, overanalyzed, and underinvested in the very technologies that are necessary to thrive in today's environment and as a result, much of retail has still been siloed into disconnected channels. Until now.

Enter COVID-19.

Suddenly, "nice to haves" like strong digital platforms, better customer pickup options and virtual engagement tools are the price of entry. Shiny objects like digital screens which, honestly, are rarely used in most retail stores (as noted by my colleague Lauren Bitar last week), are now germ magnets that most shoppers will not touch with a ten-foot pole; curbside pickup programs that would have taken months to test and iterate upon have been launched in weeks, or even days; and tools to drive digital engagement are delighting consumers everywhere. There is so much exciting innovation happening so quickly that it is hard to keep up - so what took so long. Never has Plato's expression, "Necessity is the mother of the invention", been more true. As retailers look to reopen and adapt to the "new normal", there are a few key trends that I think will emerge or accelerate.

Transparency

Digital access already gives customers access to pricing and product reviews online, and supply chain and environmental impact transparency have been a hot trend for the last few years. Now it's time for retailers to up the game and take transparency to the next level. Customers will increasingly need access to store occupancy levels, inventory availability, and details on how retailers are taking the health and safety of employees and customers seriously with operational practices.

Ideally, a shopper can look up a store online before going out for a shopping trip, understand the occupancy level and trend (i.e. low occupancy, trending higher) and make a decision on their shopping method based on the information (i.e. one may choose curbside pickup if the store is busy and the shopper knows exactly what they need). Transparency around in-store inventory is also critical for shopping missions with known purchase intent (i.e. how disappointing to don your best PPE and head out to a store only to find out they don't have what you need). This is a new mind-set for retailers and mall owners/operators as this level of transparency has simply never existed before.

Now it is critical, not just to give the transparency but to build tools on top of the data to optimize the shopper experience. For example, Yoobic has developed a virtual queuing application to eliminate lines before they form. Should there be a queue when you are trying to pay - no problem! Scan-pay-leave applications like Mishi Pay has developed will eliminate queues for check-out. With applications like these, shoppers are more in charge of their destiny than ever before.

Personalization turns Personal

Personalization has been a hot trend for the past years, with the focus typically being on digital personalization - making sure the right messaging or product reaches the right person at the right time. Advances in marketing personalization will continue to evolve but the real change is going to be the rise of personal service and shopping. Virtual appointments that include stylist sessions or make-up lessons, shopping reservations like those at Kendra Scott will be commonplace and the technology applications will continue to evolve to solve issues around sizing and styling, which will be a win for consumers. The HUGE win for retailers is that they have an incredible opportunity to get even closer to their consumers. With information comes opportunity (and responsibility). If retailers can take marketing personalization and use the data to drive better personal experiences, it is a win for everyone.

Performance Measurement

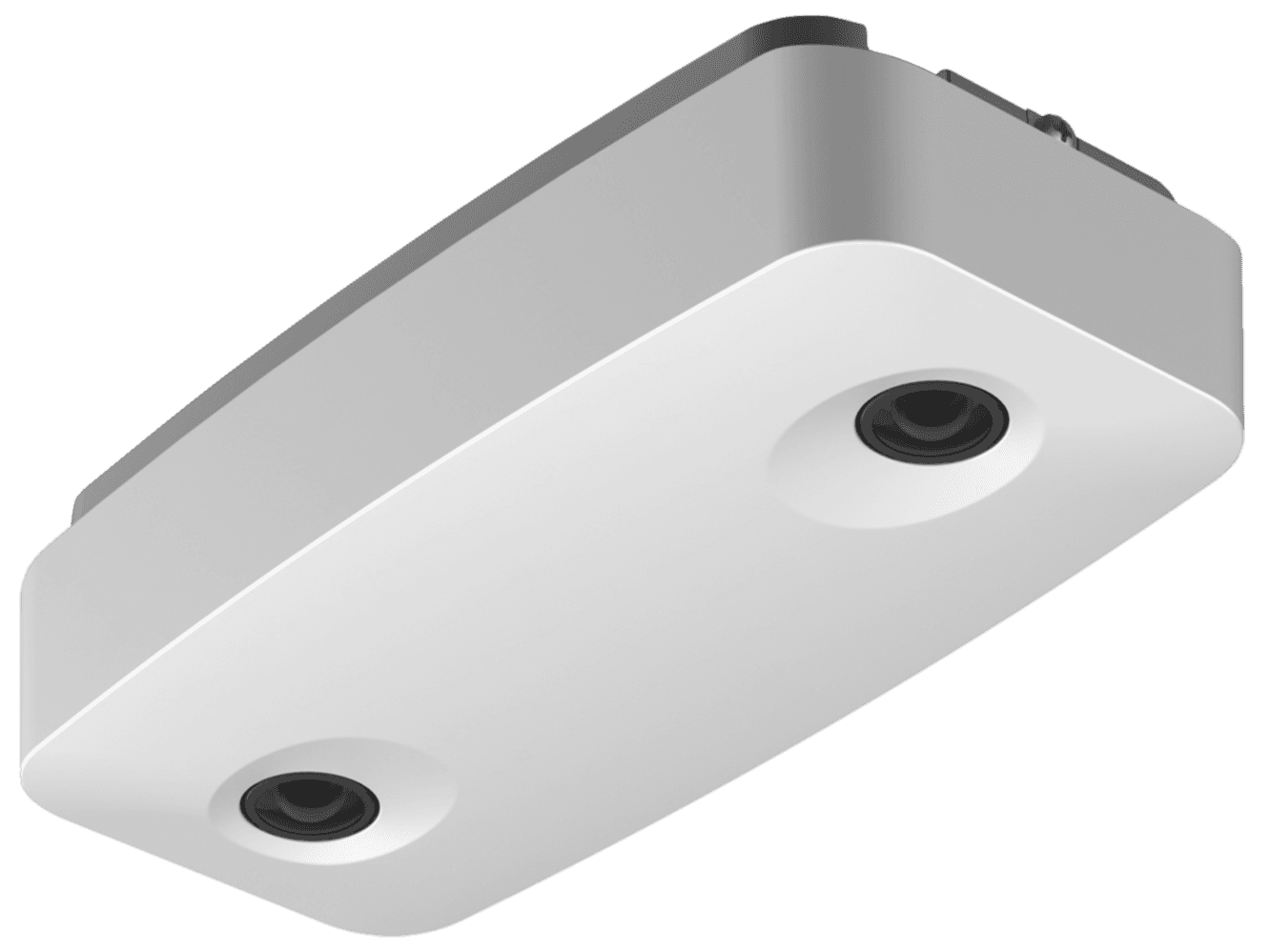

Measures to control traffic into stores are now commonplace for retailers. Target has associates standing at its entrances clicking traffic in and out on a mobile device (we have to assume this is a short-term solution as it has its own health implications for the associate, and will be replaced with technology like RetailNext's Aurora sensor soon); as noted, many retailers have implemented various customer delivery methods including expanded BOPIS, curbside pickup, and appointment shopping, and the melding of channels is stronger than ever. So how do retailers know how well their initiatives are performing? Topline sales, of course, are the #1 metric, but we all know that optimizing the metrics that make up sales are critical for location by location performance. Traditionally these metrics include traffic, conversion, shopper yield, APT, and UPT. The combination of controls on traffic, shopper reluctance to head to the mall, and the exploding options for shoppers to transact create a new set of data to consider. Shopper Yield (dollars spent per customer) will be more important than ever. Clienteling productivity (whether through virtual appointments, personal shopping, or even picking up the old fashioned phone) will be critical for specialty retailer performance. Metrics like traffic as a percent of occupancy limits will be useful as retailers understand what percent of possible traffic is visiting. Conversion goals should also be reset with new expectations. If you have as much traffic as allowed by your locale area, and conversion isn't significantly higher than pre-COVID, you have a problem.

It is NOT the End of Brick-and-Mortar Retail

There has been much written about the "last nail in the coffin", just as the "retail apocalypse" was the phrase du jour a few years ago. I don't see it this way. Sure, there will be some casualties of COVID-19. We've already seen bankruptcy filings for JCPenney, Neiman Marcus and JCrew. The challenges for retailers operating without a strong point of differentiation have only been accelerated, not created, by COVID-19.

Retail, however, has always been a creative business - one that rises to the challenges of the time and eventually adapts to the changing needs of consumers. I am incredibly inspired by the shift to the offense that I am seeing across retail, and many of our customers are being rewarded with better than expected recovery trends. After years of more talk than action and questionable investments and strategies in store of the future initiatives, COVID-19 has forced the need for rapid testing of new ways to interact with consumers and has forced the understanding of the technologies and innovation that will make the most difference. As we all tiptoe out of the shelter in place orders and find our way back to stores, my hope is that retailers will continue this rapid response to the changing market. It's entirely possible that the store of the future is not as far off as we thought.

RetailNext is supporting retailers in reopening stores through occupancy capabilities. Learn more here!

Join the #retail, #inspiringretail and #COVID19Retail conversations on Twitter @bridgetjohns, @RetailNext, LinkedIn at and www.facebook.com/retailnext.

About the author:

Bridget Johns-Pavlopoulos, Head of Marketing, RetailNext