Back-to-School 2025 Data: Fewer Trips, Smarter Spending

On this page

The 2025 back-to-school season revealed a fundamental shift in how families approach one of retail's most important shopping periods. Our analysis of over 7 million shopping trips across thousands of U.S. stores shows parents aren't just shopping differently; they're shopping strategically.

Key Finding

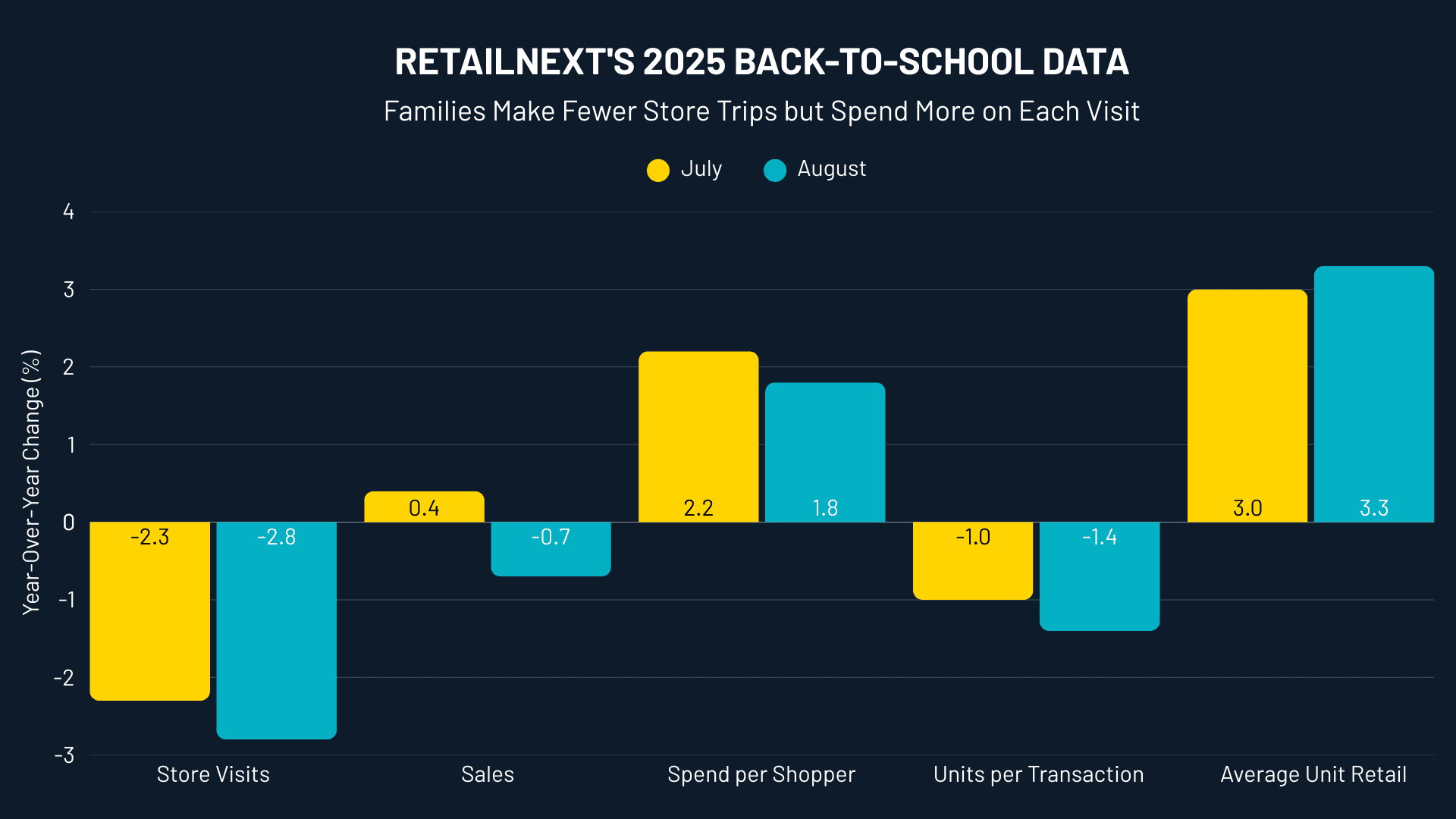

While store visits declined 2.3% in July and 2.8% in August compared to last year, families spent more per trip, keeping overall sales nearly flat. This consolidation strategy marks a departure from the traditional multiple-trip shopping pattern.

YOUR NEXT READ 👉 Retail In 2030: Technological Possibilities In Stores

The New Shopping Equation: Quality Over Quantity

Parents made a clear trade-off this year. They visited stores less frequently but made each trip count. July saw visits drop 2.3% while sales inched up 0.4%. August followed a similar pattern with visits down 2.8% and sales declining just 0.7%.

What drove this resilience in sales despite fewer visits? The answer lies in spending behavior. Shoppers increased their spend per visit by 2.2% in July and 1.8% in August. Interestingly, they bought fewer items per transaction (down 1.0% in July and 1.4% in August), but paid more for each item, with average unit retail prices up 3.0% in July and 3.3% in August.

Category Winners And Losers

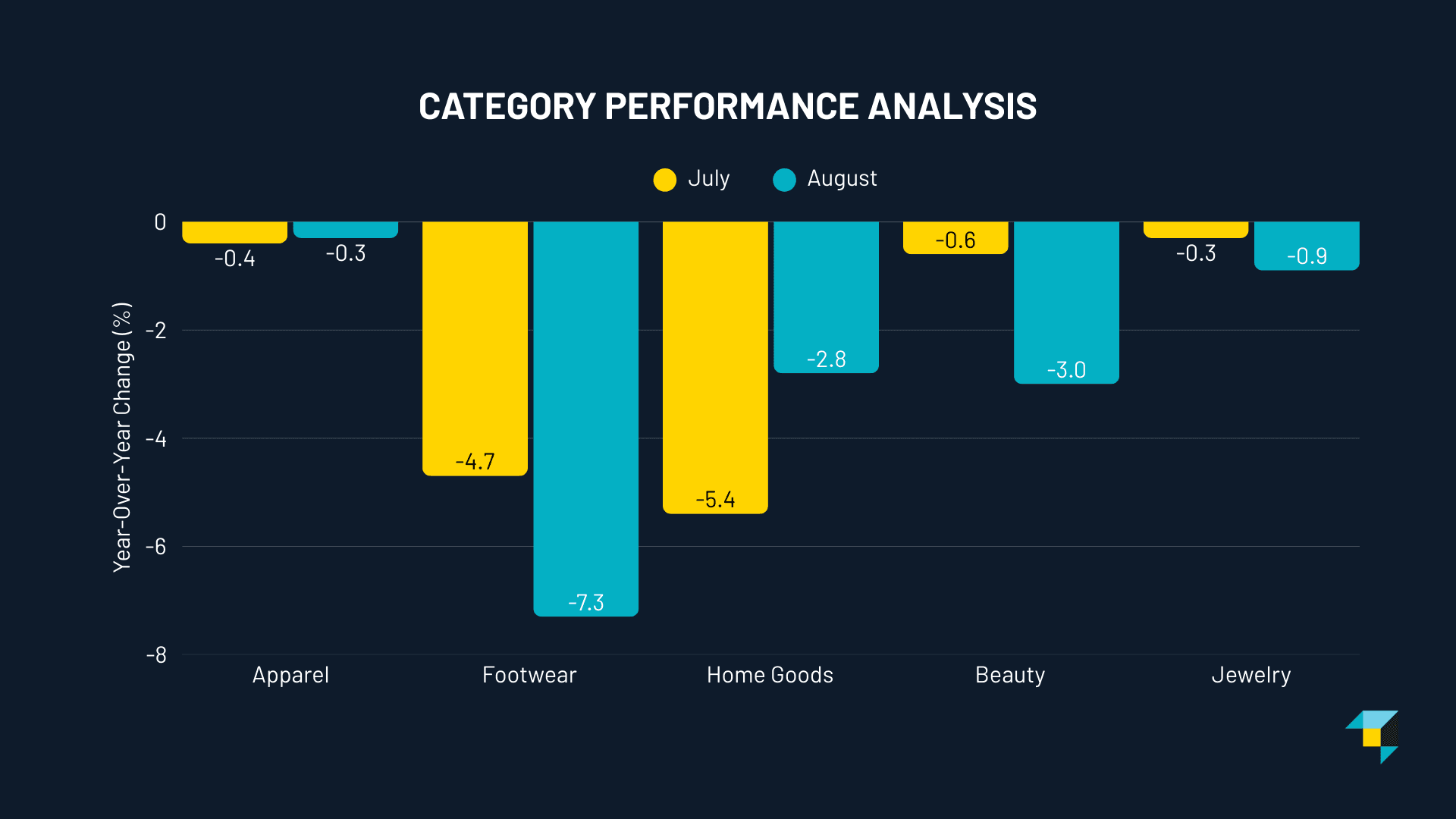

Not all retail categories fared equally during the back-to-school rush. Apparel proved remarkably resilient, with traffic declining just 0.4% in July and 0.3% in August. This stability underscores clothing's position as the non-negotiable back-to-school purchase.

Footwear tells a more nuanced story. While year-over-year performance was weak (down 4.7% in July and 7.3% in August), the category saw significant spikes during peak shopping weeks. From early July through early August, footwear traffic jumped 13% above June's average and 11% higher than late August, showing concentrated demand around key shopping moments.

The pullback in discretionary categories sends a clear message. Home goods fell 5.4% in July and 2.8% in August, while jewelry edged down from 0.3% in July to 0.9% in August. Families focused their spending on classroom essentials while scaling back on extras.

NEXT ON YOUR WATCHLIST 👉 Retail Trends: Where Retailers Miss The Mark

Malls Make A Comeback

Traditional enclosed malls emerged as the preferred shopping destination, staying flat in July (0.0%) and declining only 0.9% in August. This performance significantly outpaced other formats. Luxury centers even posted a small gain in July (+0.1%) before softening in August.

Lifestyle centers, despite their mixed-use appeal combining retail with dining and entertainment, underperformed at -3.1% in July and -3.0% in August. Outlets fared worse (-3.7% in July, -4.0% in August), suggesting that discount positioning alone wasn't enough to drive traffic.

Regional Resilience Varies

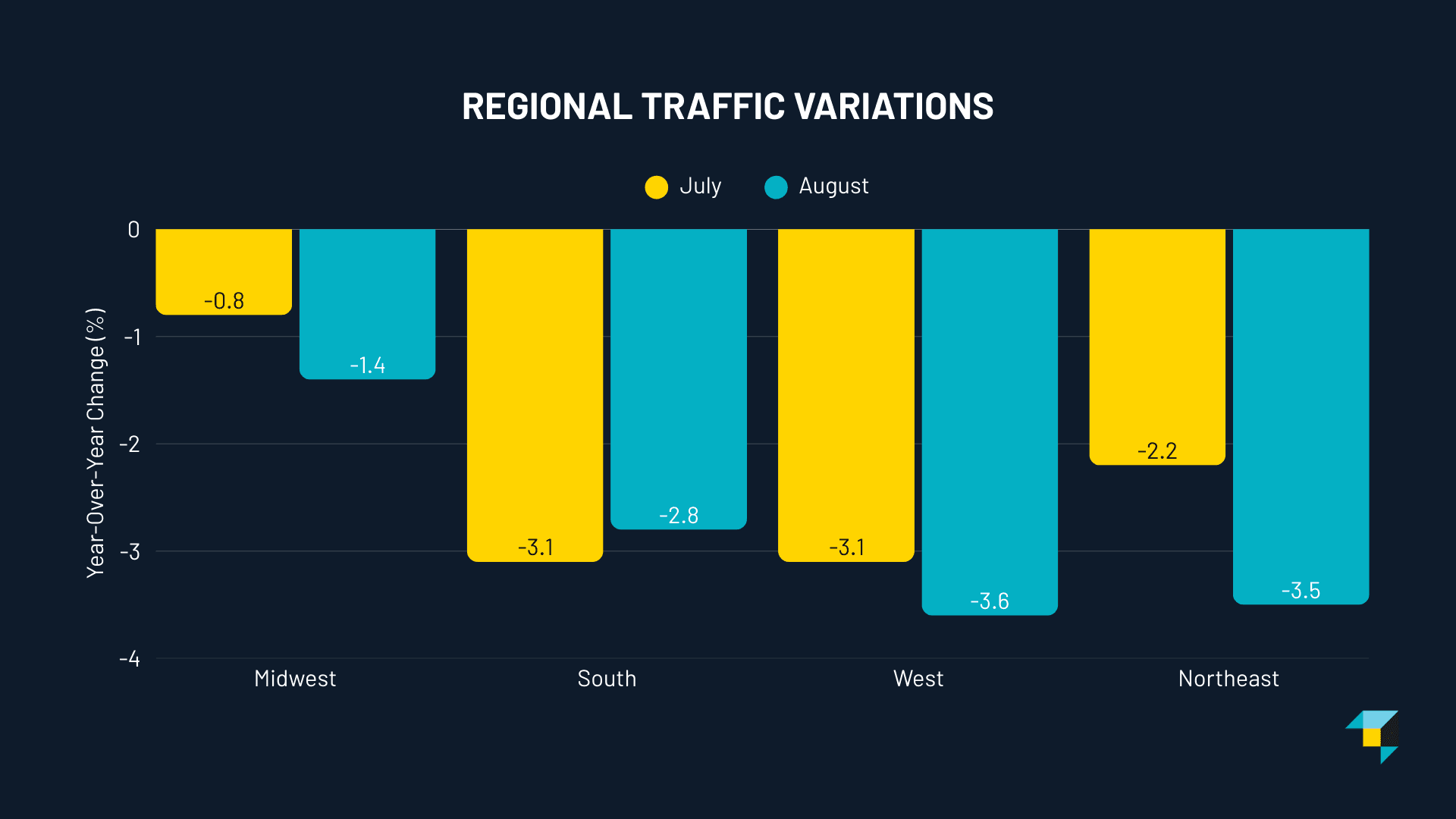

The Midwest showed the strongest performance, with traffic declining just 0.8% in July and 1.4% in August. The South tracked close to the national average at -2.8% in August, improving from July's -3.1%. Coastal regions experienced sharper declines, with the West falling from -3.1% in July to -3.6% in August, and the Northeast sliding from -2.2% to -3.5%.

A Bright Spot In An Otherwise Challenging Year

Context matters when evaluating back-to-school performance. While traffic remained below last year's levels, July and August represented some of 2025's strongest months. Earlier in the year, U.S. store visits were down more sharply: -4.4% in February, -4.2% in March, and -4.3% in June. Against this backdrop, the smaller declines during back-to-school season signal relative strength.

What This Means For Holiday Shopping

The back-to-school shopping patterns offer retailers a preview of potential holiday behavior. The consolidation of shopping trips, focus on value, and preference for enclosed malls suggest consumers are becoming more deliberate in their shopping habits.

"Back-to-school shoppers were careful but decisive. Families cut trips, spent more per visit, and prioritized apparel and enclosed malls over other categories and formats. It's a clear sign of how consumer confidence may impact shopping behavior heading into the holidays."

- Joe Shasteen, Global Manager of Advanced Analytics at RetailNext

Retailers preparing for the holiday season should note three key lessons from back-to-school 2025. First, consumers are willing to spend but want to minimize shopping trips. Second, essential categories will outperform discretionary ones. Third, the convenience and variety of traditional malls continue to resonate with shoppers.

As we move toward the critical fourth quarter, retailers who can deliver value, convenience, and a compelling product mix stand to capture a larger share of these consolidated shopping trips. The back-to-school season has shown that while traffic may be down, the opportunity to capture spend remains for those who adapt to evolving consumer preferences.

READ MORE 👉 Spooktacular 'Summerween': 2025 Halloween Retail Trends

About the author:

RetailNext

RetailNext is an award-winning global leader in retail analytics for physical stores. Our real-time analytics tools help retailers collect, analyze, and visualize store data. RetailNext collects data from nearly 100,000 sensors in retail stores to measure more than one billion shopping trips per year.