Big Box Innovation: In-Store Analytics Drives The Show

On this page

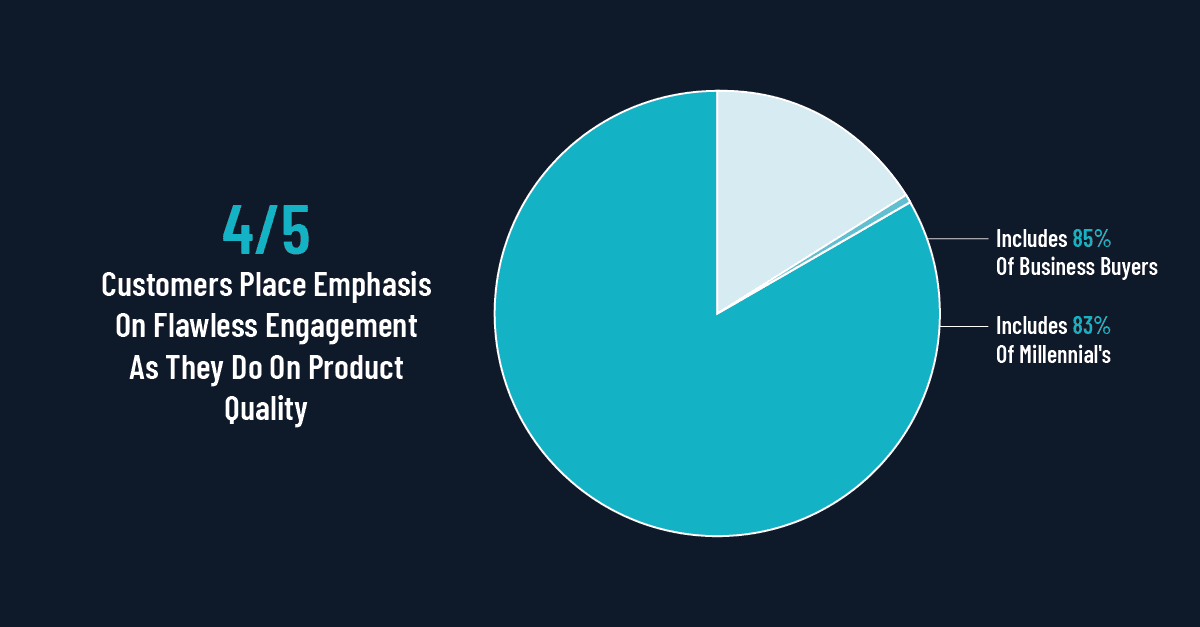

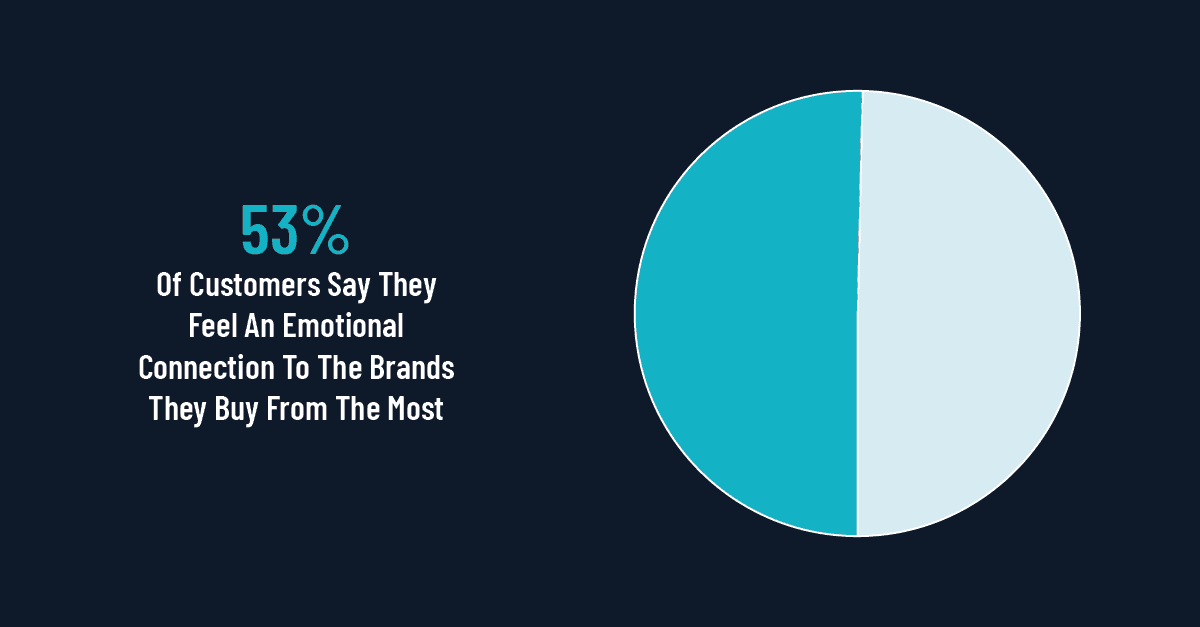

It goes without saying that the sheer size of Big-Box retailers' operations has lent itself to the domination of smaller brick-and-mortar stores. But since the start of the Covid-19 pandemic, that playing field has been leveled somewhat as many businesses were forced to innovate and accelerate their operations with unprecedented speed and scale. But while the size of operations does have its place in a successful business environment, ensuring a high-quality customer experience still reigns supreme as a key competitive differentiator and revenue accelerator.

(Data Source: Salesforce Research)

Experiential Stores

Many retailers with a large store footprint have been awake to these changes for some time now, responding with the creation of experiential store formats in smaller volumes to explore new verticals that drive a unique customer experience. Store formats such as Sobeys Express, TargetExpress, and Walmart To Go focus on convenience while also building the new big-box experience by revamping retail interiors with sushi bars, cafes, and much more.

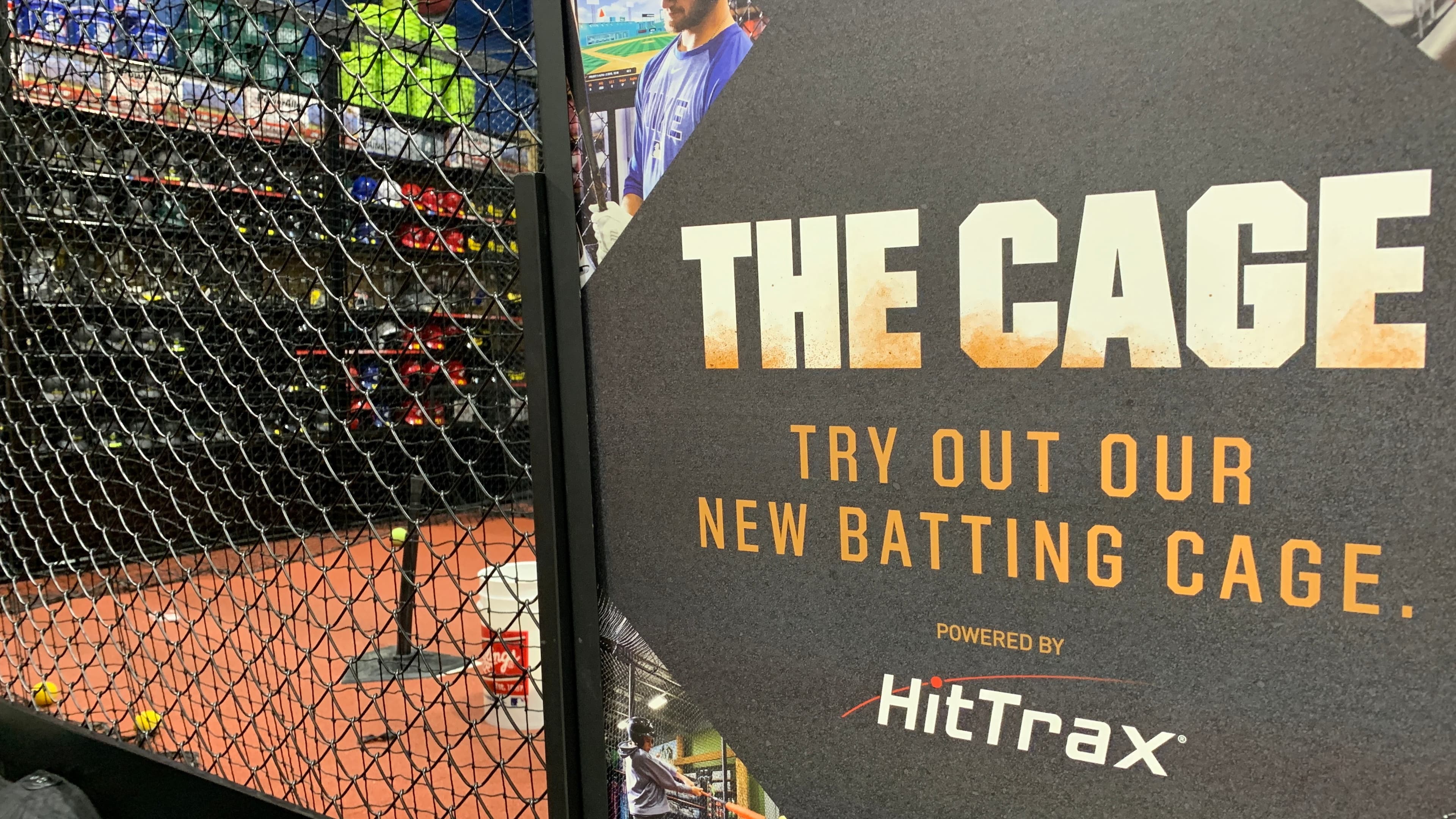

Dick’s Sporting Goods has introduced its customers to rock climbing, an outdoor turf field, a batting cage and golf hitting bays with simulators at The House of Sports in Victor, New York and Knoxville, Tennessee.

Tiffany’s Blue Box Cafe is a physical extension of the luxury brand, offering an elegant dining experience and a menu created on regionally sourced ingredients.

H&M’s ‘Repair and Remake’ station at its concept store in London encourages customers to recycle garments.

In-Store Analytics Drives The Show

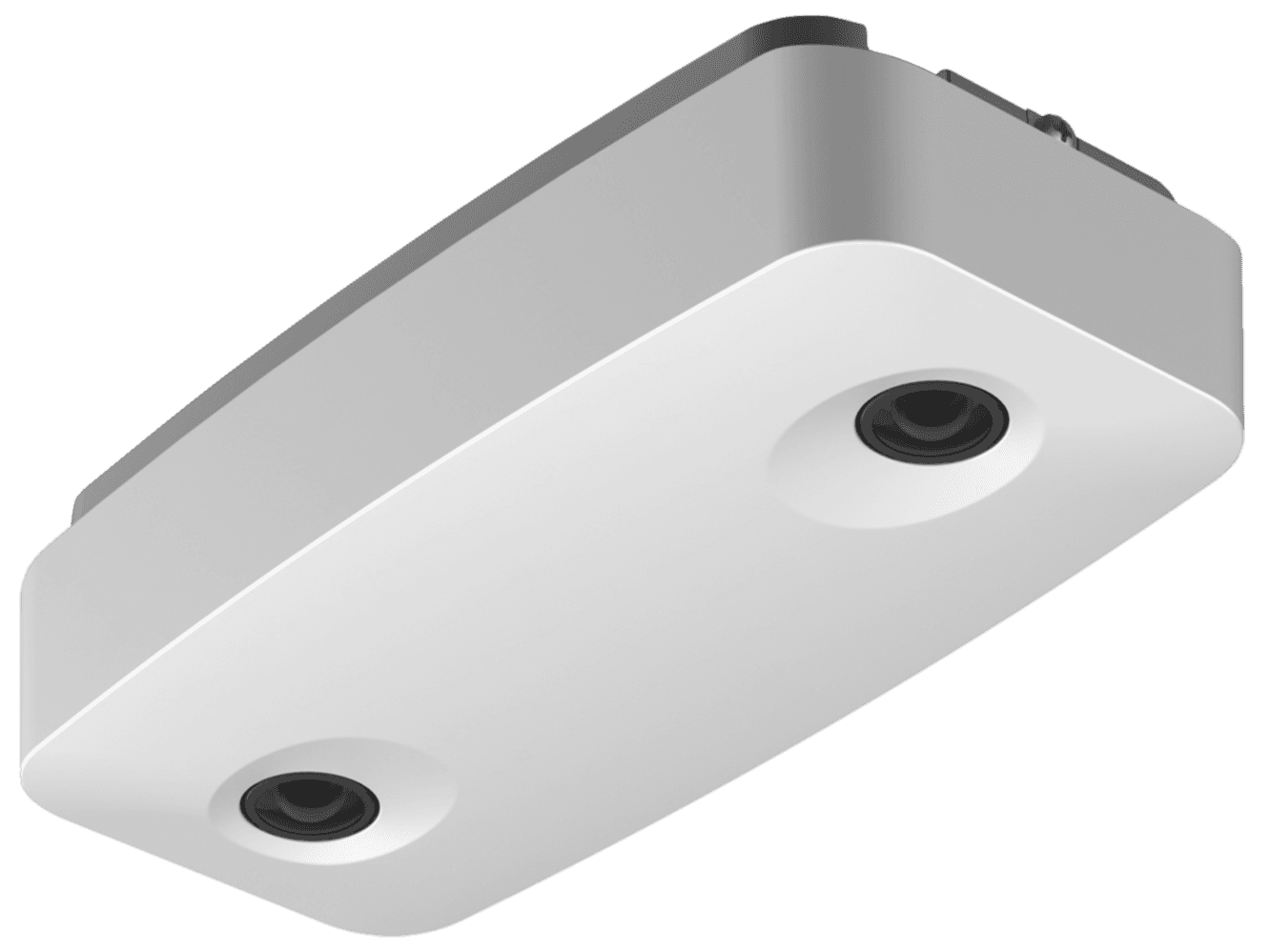

These future-focused spaces are designed to experiment with what other store experiences could look like. At the heart of this industry innovation is the reliance on in-store analytics to provide a deeper understanding of how customers are responding to these new store environments and, more importantly, how they are behaving when inside the store.

Comprehensive store data with multiple data points help to build a single yet detailed view of the shopper journey to better understand how customers traverse in a particular area of the store or what makes them stop versus walk-by certain products etc. Armed with these shopper data points, retailers have the ability to zero in on the in-store behavior of specific shopper profiles.

Retailers can then accurately test out the success of new store formats, identify potential opportunities to optimize in-store experiences, and make solid data-driven decisions on future rollouts of new store concepts.

4 Examples Of How In-Store Analytics Enhanced Customer Experiences

Let’s take a look at four use cases of smart store analytics via the RetailNext platform that helped retailers to better understand their shoppers' behavior in order to optimize in-store experiences.

1. Understanding The Impact Of Experience Areas

Initiative

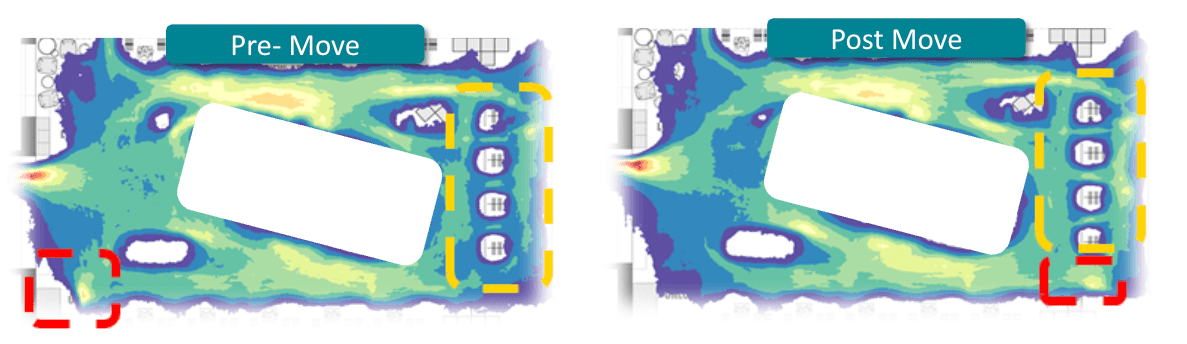

An athletic and footwear brand was looking to improve its shopper flow to the back of the store. In addition, they also wanted to reduce the percentage of shoppers who would only visit the store to make use of a free vending machine, and subsequently leave the store. The brand decided to move the fixture to the back of the store and re-measure the initiative using the RetailNext platform.

Impact

Following the move, shopper activity to the vending machine flowed to the rear of the store.

The percentage of shoppers who would only come in to use the vending machine, and leave, dropped from 25% to 13%.

Average zones shopped by shoppers, who stayed in the store after using the vending machine, increased from 4.7 to 6 and they shopped more zones in the rear of the store.

2. Testing Fixtures Before Rolling Out To All Stores

Initiative

In this use case, a beauty brand wanted to test out a new vanity in the hopes that it would inspire shoppers to engage and interact with products on their own. The performance of the fixture was of particular importance to the brand as each fixture carried a cost of $15,000.

Impact

The RetailNext platform showed there was a low percentage of traffic and low engagement compared to adjacent areas, indicating shoppers skip over vanity.

Additionally, there was a low average dwell time which indicated customers were not interacting with the area.

There was no improvement in metrics from the previous fixture in that location.

The findings at the store also matched feedback from store associates at other test stores.

The brand decided not to roll out fixtures to the rest of its fleet, avoiding a $400,000 investment that would not improve their shoppers’ experience.

3. Improving Sales Through Better Shopper Flow

Initiative

While reviewing its parasol sales, a department store realized that its results were being impacted by shoppers not flowing into the area. It decided to test whether removing a front table, to improve product visibility, and reducing assortment by 30% would help to improve sales.

Impact

The new layout better displayed products to the pass-by shoppers and allowed easier shopping.

Shopper exposure to the area increased from 76% to 82%.

Following the change, parasol sales improved 16% compared to LY, which was a $3,000 per week improvement in just one area.

4. Ensuring The Best Staff Placement

Initiative

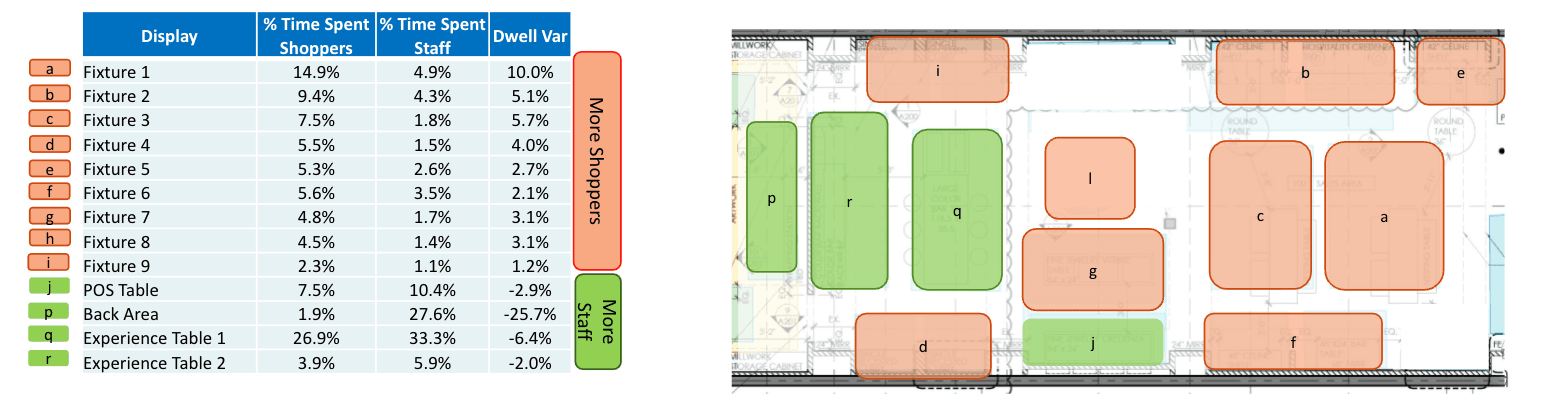

After a jewelry brand invested in employing more staff at their store, they noticed that the conversion rate had not significantly improved. Using RetailNext’s ability to separate staff and shoppers, they investigated the placement of staff throughout the store.

Impact

The store data revealed that staff was spending too much time in the back area, where gift wrapping was located.

The brand was able to identify an opportunity to move gift wrapping to the floor to improve staff placement while also enhancing their in-person experience.

You Can Do It Too

Harnessing the power of in-store analytics to innovate and grow your business is not exclusive to big-box retailers. The beauty of in-store data analytics is its ability to roll out at scale and across industries to drive growth and profitability and improve customer experiences.

Pure-play digital retailers, for example, are venturing into traditional brick-and-mortar retail to help drive seamless shopping experiences. While Ridgelinez, a strategy consulting firm, implemented retail analytics to measure and analyze how customers are navigating and interacting with various gaming machines inside an arcade game center.

Click HERE to read more about it.

About the author:

Judith Subban, Marketing Communications Manager, RetailNext