Executive Sessions: Top Insights From 2024 U.S. Retail

On this page

- Stability And Challenges In Retail Traffic And Sales

- Seasonal Shopping Patterns: The Importance of Key Dates

- Understanding Modern Shopping Preferences

- Managing Customer Frustrations

- Conversion Strategies: Inventory Models And Promotions

- Optimizing Operations With Data-Driven Staffing And Layouts

- Looking Ahead: Retail’s Future Is Experiential

The retail landscape has never been more complex or dynamic, with businesses continuously adapting to shifting consumer preferences, technological advancements, and economic pressures. In a recent series of Executive Sessions, industry leaders Joe Shasteen, RetailNext Global Head of Advanced Analytics, and Andrew Neelon, Founder of 1Rec and SVP of Development & Strategy Elase Med Spas, shared their insights on navigating these evolving trends.

The sessions provided data-driven perspectives on current U.S. store trends, the critical role of holiday sales, and actionable strategies for optimizing both in-store and omnichannel retail experiences.

MORE BY ANDREW 👉 Data-Driven Expansion: DTC Brands Explore Stores

Stability And Challenges In Retail Traffic And Sales

RetailNext’s data highlights a persistent challenge in U.S. retail: while foot traffic has remained relatively stable, sales growth has slowed. This trend underscores the increasing difficulty in converting visits to purchases. Although traffic in 2023 was down about 1% from the previous year, sales saw a more substantial 3% drop, reflecting a need for stronger engagement and conversion tactics within stores. The data also points to shifting consumer priorities, with inflation contributing to a more cautious approach to spending as consumers focus on value.

Neelon emphasized the complexity of this environment, noting that consumers are now more likely to browse in stores but complete purchases online (a trend amplified by the digital shifts during and after the pandemic). He urged retailers to look beyond foot traffic data, suggesting that insights into local online activity can provide a fuller picture of consumer behavior. Additionally, he observed that despite these traffic challenges, real estate vacancies in retail remain low, suggesting demand for physical retail spaces persists, though finding optimal locations remains competitive.

Seasonal Shopping Patterns: The Importance of Key Dates

As the holiday seasons approach, event-specific days like Black Friday and Super Saturday are expected to drive short-term traffic surges. In 2023, RetailNext observed a 2% traffic increase on Black Friday compared to the prior year, with even higher spikes just before Christmas. This trend demonstrates how critical these specific dates are to boosting sales in an otherwise restrained retail environment. To maximize these periods, retailers should focus on promoting in-store events and limited-time offers that create urgency and excitement, encouraging customers to shop in person.

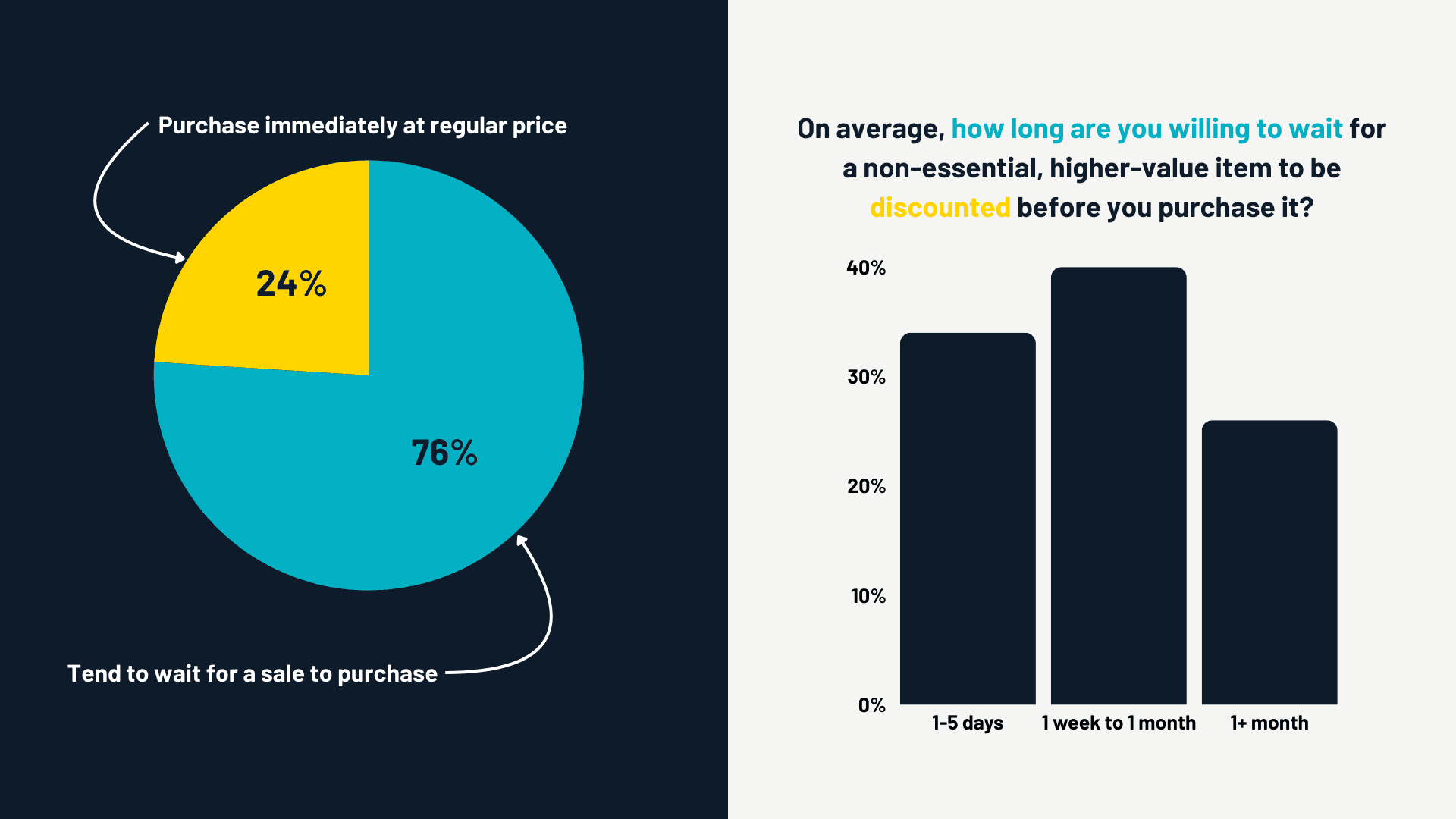

Neelon added that while holiday sales can bolster overall performance, there’s a risk of relying too heavily on promotions, which can erode margins and reduce the effectiveness of non-promotional periods. Extending holiday promotions has become a common strategy, yet retailers must weigh the short-term gains against potential long-term brand health. According to Neelon, a balanced approach—combining occasional promotions with everyday value—is essential for sustained growth.

Understanding Modern Shopping Preferences

The Executive Sessions also featured findings from our latest U.S. consumer sentiment survey. This survey explored the shopping behaviors of over a thousand consumers, aged 18 to 64, and highlighted two key insights:

the resilience of in-store shopping, and

the demands of a younger, digitally savvy audience.

About 65% of respondents reported shopping in physical stores weekly, especially in younger demographics. Notably, younger consumers are more likely to leave stores without purchasing, reflecting their more discerning and research-driven shopping habits. They tend to prioritize factors like price and availability and are more likely to walk away if they perceive a better deal online.

This demographic data presents both opportunities and challenges for retailers. Younger shoppers are frequent visitors, but converting their visits into sales requires targeted efforts. Neelon pointed out the importance of a seamless omnichannel experience that resonates with these consumers' tech-savvy habits. Integrating in-store and online data, personalized offers, and streamlined purchasing options can help bridge the gap between in-store engagement and final sales.

READ THE SURVEY 👉 2024 U.S. Consumer Sentiment Survey

Managing Customer Frustrations

Certain frustrations persist despite consumers' enthusiasm for in-store shopping, impacting conversion rates. According to the survey, long lines, crowded aisles, and out-of-stock products were top deterrents for many shoppers. Additionally, older consumers were more likely to cite a lack of staff assistance as a significant pain point. These insights emphasize the need for retailers to address operational challenges and ensure their stores are equipped to meet consumer expectations.

Neelon highlighted that budget constraints often lead to staff cuts, exacerbating these issues. However, he suggested a shift in focus toward managing traffic rather than purely transactions. Retailers who can align staffing levels with peak shopping times will improve service quality and potentially reduce customer frustration, helping to retain and convert more visitors. Additionally, understanding which areas of the store attract high traffic and optimizing displays and product availability in those zones can further enhance the customer experience.

Conversion Strategies: Inventory Models And Promotions

With inventory shortages and high prices identified as two major factors driving customers to leave stores empty-handed, retailers may need to rethink their inventory strategies. Neelon recommended exploring showroom or inventory-less models as potential solutions. By displaying a range of products without committing to extensive in-store inventory, retailers can provide an engaging, curated experience while minimizing stock management burdens. Additionally, integrating endless aisle technology, allowing shoppers to order items not physically present, can offer the convenience of online shopping within a brick-and-mortar environment.

When it comes to driving impulse purchases, the survey found that limited-time offers and visually appealing displays were the most effective motivators. Seasonal events and strategic in-store displays play an important role here, giving customers a reason to browse and purchase on the spot. As social media and digital advertising continue to influence consumer habits, Neelon suggested retailers could benefit from targeted promotions that align with these in-store motivators. Younger consumers, in particular, are more influenced by social media, presenting an opportunity for retailers to amplify their promotions on digital channels.

READ MORE 👉 Why Gen Z Is Not Sleeping On Shopping At Malls

Optimizing Operations With Data-Driven Staffing And Layouts

In-store analytics remain a powerful tool for retailers striving to meet the demands of a competitive market. The Executive Sessions stressed the value of using traffic and conversion data to inform staffing and store layout decisions. Shasteen advised that rather than staffing according to sales, retailers should align staffing levels with traffic data to ensure that employees are available when footfall is highest. This proactive approach can prevent long lines and enhance the overall shopping experience, particularly on peak days and during holiday rushes.

Furthermore, tracking in-store dwell times and identifying popular areas can provide insights into non-converting behaviors. Retailers who use this data to improve product placement and promotional displays can create a more engaging experience, encouraging customers to explore and ultimately convert. RetailNext’s consumer sentiment survey also underscores the importance of cross-brand collaboration. By sharing traffic and sales data with brand partners, retailers can support targeted promotions, optimize staffing, and enhance service quality, making the store environment more effective for everyone involved.

Looking Ahead: Retail’s Future Is Experiential

The rise of experiential retail is evident, particularly around the holidays when consumers crave more than just transactions. Retailers who provide immersive, memorable shopping experiences will gain a competitive edge, especially with younger generations who value these experiences. As Neelon remarked, holiday shopping has become a unique opportunity for retailers to showcase their brands, offering festive atmospheres and personalized service that differentiate in-store visits from online purchases.

With the insights provided by RetailNext and actionable strategies from these Executive Sessions, retailers can adapt to the evolving landscape by focusing on omnichannel integration, operational efficiency, and enhanced customer experiences. These strategies not only address current retail challenges but also position stores for long-term success in a highly competitive industry.

WATCH THE SESSIONS NOW 👇

About the author:

Ashton Kirsten, Global Brand Manager, RetailNext

Ashton holds a Master's Degree in English and is passionate about physical retail's unbridled potential to excite, entertain, serve, and solve problems for today's shoppers.