Highlights: The FIFA Soccer World Cup's Impact On Retail

On this page

In a recently published eBook, we set out to measure and analyze the impact of the FIFA Soccer World Cup on key shopping occasions like Black Friday, Cyber Monday, and the festive period. For the first time in World Cup history, the 2022 installment of the prestigious tournament was hosted in Winter to overcome concerns about the heat in host nation Qatar. With the final match held on 18 December 2022, retail was forced to rethink its time-tested festive strategies.

The adjusted season meant that the tournament overlapped with Black Friday, Cyber Monday, and the traditional Christmas shopping period, leaving retailers navigating uncharted territory with fears of diminished sales and highly irregular merchandising needs. So, were retailers able to avoid penalties and score despite irregular buying patterns? Or did the high-volume period just get Messi?

⚽️ DOWNLOAD THE FREE eBOOK TODAY: Retail Scores: The FIFA Soccer World Cup

Black Friday Match Day

All group stage matches for the USA and UK took place on the same dates and the two teams squared off against each other on Black Friday (25 November 2022) in a match that ended in a draw.

In the USA, the November 2022 traffic decreased by 0.9% compared to 2021, recording the lowest YoY trend of 2022. However, Black Friday proved to change the pace and bring shoppers back to stores towards the end of November, soccer notwithstanding. In fact, foot traffic during all three of the USA’s Group Stages fixtures showed footfall at stores increased for the 90-minute period.

But just like their UK counterparts, shoppers showed less purchase intent indicated by Black Friday’s negative CVR and Shopper Yield trends at -1.3%, and -6.8% compared to last year. The average transaction value on Black Friday had a softer trend at -1.2% YoY as well, lower than overall November 2022.

In the UK, traffic declined year-over-year during the first and last matches for the Group Stages, with traffic for November 2022 up by 4.7% compared to 2021. This is undoubtedly contextualized by the broader retail landscape in which retailers have had to contend with a huge amount of disruption, such as inflation, the ever-rising living costs, and rail strikes, and have worked hard to generate strong levels of shoppers in-store. After Black Friday, traffic was consistently on the rise, if modestly, laying a solid foundation for the first festive period largely unaffected by the Covid-19 pandemic.

The British Retail Consortium reported that sales picked up as Black Friday discounting marked the beginning of the festive shopping season. The Black Friday bargains saw retail sales grow by over 4% in November 2022, which undoubtedly served as a much-needed boost after such a tumultuous year. However, sales growth remained below current levels of inflation, suggesting sales volumes were down from 2021.

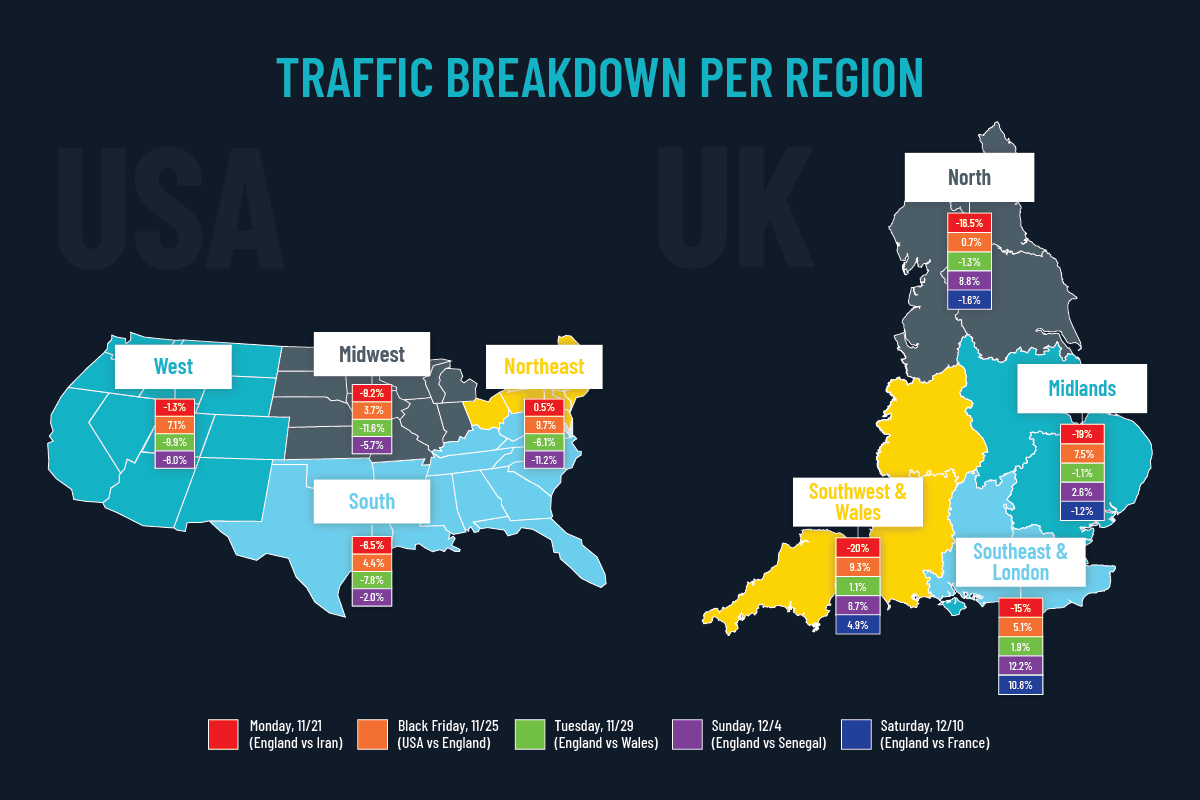

Regional Traffic Rundown

In the USA, the Northeast reported the highest traffic on Black Friday (when USA vs England) and Midwest sported the lowest on the next match. In-store turnout was strong, despite the gameday festivities.

In the UK, overall store traffic was up, with the Southwest and Wales winning Black Friday traffic with a 9.3% increase in traffic from 2021. Interestingly, from Black Friday onwards, traffic trended positively year-on-year.

Round Of 16 Recap

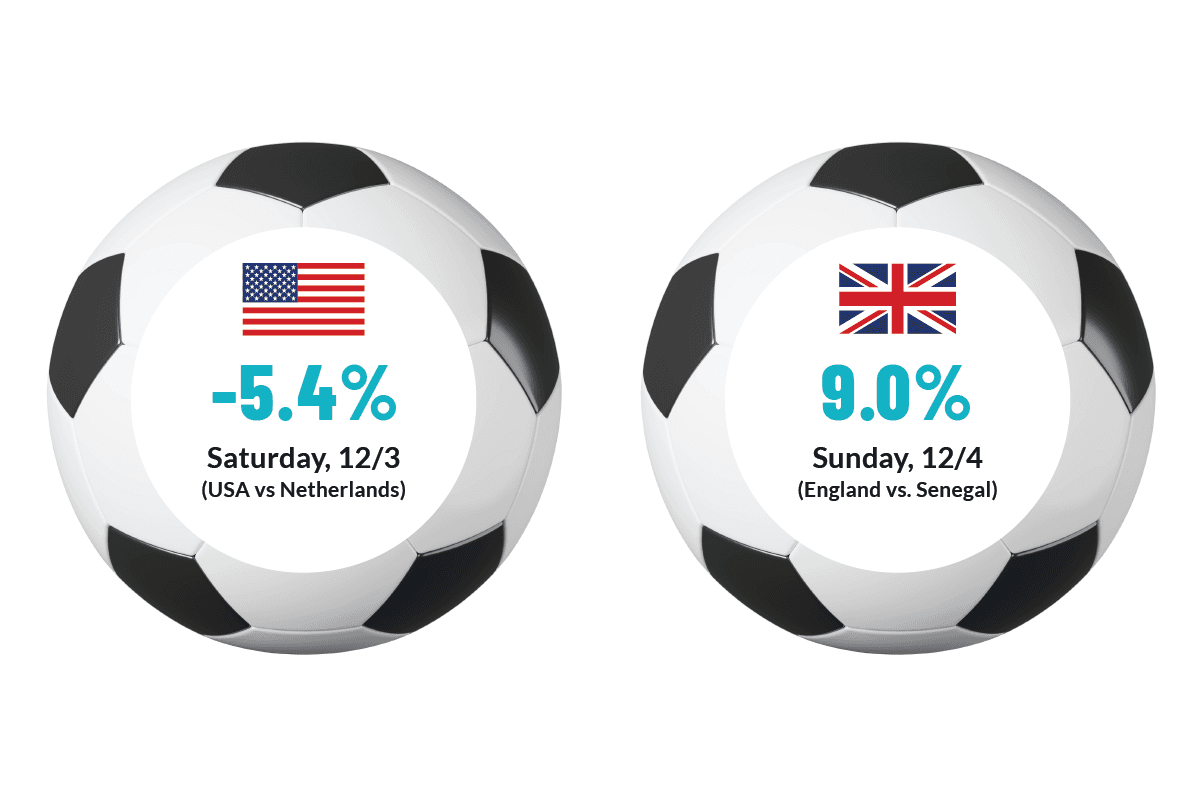

Both countries played their Round of 16 matches on the same weekend. On Saturday, 3 December 2022, the USA faced off against the Netherlands, with the Netherlands taking the victory 3-1. The next day, Sunday, 4 December 2022, England won 3-0 against Senegal. With so much action-packed soccer on the go, did shoppers make it to the stores?

UK shoppers were totally undeterred by any fixture-related fuss and kicked off the festive season with a YoY traffic increase of over 14%! Traffic showed strong gains in that week, climbing 8.1% compared to the year before. Interestingly, the day before the UK’s Group 16 fixture (Saturday, December 3, 2022) was also the third busiest day at stores for the festive season (November 27, 2022 - December 31, 2022).

On the other hand, in the USA, turnout was significantly lower than on the same day in 2021. The match was broadcast at 10AM ET/7AM PT, therefore making it relatively unlikely to have impacted longstanding shopper habits. So how much of this deviation can really be attributed to the showdown with the Netherlands? Other factors that may have influenced the decline in store traffic may include spendthriftness in the wake of rising living costs, festive shopping being done over Black Friday to capitalize on deals, and compelling buy-online pick-up in-store (BOPIS) offers.

⚽️ READ THE FULL eBOOK FOR FREE: Retail Scores: The FIFA Soccer World Cup

The Festive Season Scored

Traffic data collected over the 2022 festive period (November 27 - December 31, 2022) shows a heartening return to brick-and-mortar stores in both the USA and UK, despite the World Cup, inflation increases, and strike action.

The USA

Traffic for the holiday period increased by +1.1% over last year, with the highest peak recorded in the last week of December 2022 when footfall spiked by +22.9%. These encouraging traffic trends are aligned with the positive sales results for the period, providing a much-needed boost as the retail industry looks to January to set the tone for 2023.

At the beginning of 2022, traffic put in a strong performance over 2021 with footfall in the mid-twenties and above. However, there was a consistent decline in footfall from March 2022 with traffic reaching negative territory in November 2022. In part, this is attributed to the inflationary pressures and macroeconomic factors that consumers are facing, but we're also seeing a post-pandemic emergence for retail.

The UK

Traffic for the holiday season increased by +10.6% over last year, with the highest peak recorded in the last week of December 2022 when footfall spiked by +29.7%. These encouraging traffic trends are a critical beacon to retailers challenged by store closures that were reported for 2022.

“Each week’s traffic over the six-week period recorded strong gains compared to 2021. We see a notable peak in the week of Christmas 2022 and Super Saturday increased traffic by almost 11% year-over-year on the day. These overall positive traffic trends show an increasing willingness from consumers to return to stores”, said Joe Shasteen, Global Manager of Advanced Analytics, in a recent RetailNext release.

“Of course, with the cost of living crisis and challenges of the rail strike, there is a shift in UK traffic patterns for the season when compared to 2019. The six-week period indicates UK footfall declined by -16.7% compared to 2019, but climbed +0.8% in the last week of December, perhaps highlighting the increased attraction of end-of-year pricing and promotions.”

The data shows that the FIFA World Cup being positioned as “the nightmare before Christmas” because of its projected disruption of festive shopping is unfounded. On the contrary, trends show that there was a notable YoY increase in store traffic for both the UK and the USA.

Our research shows that the fixtures had no significant impact on shopper turnout. If anything, shoppers opted for savvier deals and smaller baskets because of widespread anxiety around inflation and resultant spikes in the cost of living, factors totally independent of the esteemed tournament.

For the full analysis, read our eBook online or download it for free today!

About the author:

Ashton Kirsten, Global Brand Manager, RetailNext

Ashton holds a Master's Degree in English and is passionate about physical retail's unbridled potential to excite, entertain, serve, and solve problems for today's shoppers.