Holiday Season Tips: Using In-Store Analytics To Win

On this page

Many shoppers have already begun their holiday season buying this week. Despite the trifecta of macroeconomic tailwinds from the ongoing challenges of the global pandemic: concerns about the delta variant, supply chain and workforce constraints, the National Retail Federation (NRF) says that consumer confidence remains solid and it expects a strong holiday season for retailers. 2021 is set to be a record year for retail sales, according to the NRF's growth forecast of between 10.5%-13.5%.

But even so, this year’s holiday season will be characterized by a number of marketplace dynamics such as an early start to shopping, higher price tags, and increased demand for enhanced digital experiences (Mastercard Spending Pulse). Let’s look at the key takeaways for brick-and-mortar stores from the holiday season trends and how in-store analytics, far beyond in-and-out traffic counts, can help them maximize these opportunities.

Holiday Season Trends: Key Takeaways

TREND 1 - Traffic And Sales Are On The Up

Consumers have the desire and the means to spend this year, fueled in part by pent-up savings and the government stimulus. According to the latest Mastercard Spending Pulse, US retail sales are expected to grow 7.4% this holiday season. In-store sales are forecast to grow at 6.6% compared to 2020, as the return to in-store browsing and shopping continues.

TREND 2 - Increased Strain On The Supply Chain

The increased demand for products and services, associated with holiday season buying, will place further pressure on the already constricted supply chain. This, together with rising shipping costs, reduced space at warehouses, and the shortage of truck drivers, are expected to further impact the availability and delivery of products.

Many retailers have already expressed concern that toys will be in short supply while Christmas trees and decorations are also expected to be more expensive. The price tag on electronics is also likely to increase as a result of the global semiconductor chip shortage.

TREND 3 - Early Shopping

As a result of growing concerns about the availability of products, early holiday shopping is expected to have begun with 17% of consumers planning to buy gifts by October 2021 (Sitecore’s Holiday Season Trends Report 2021).

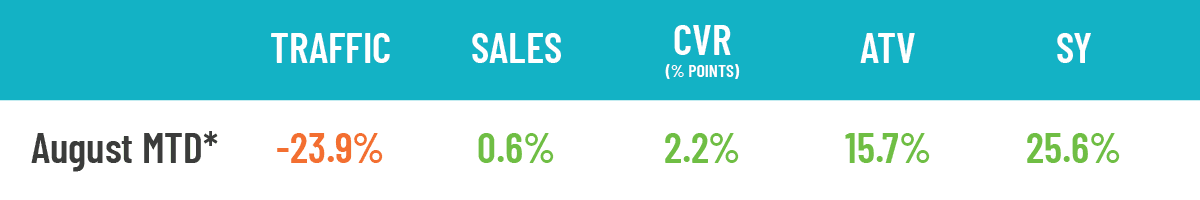

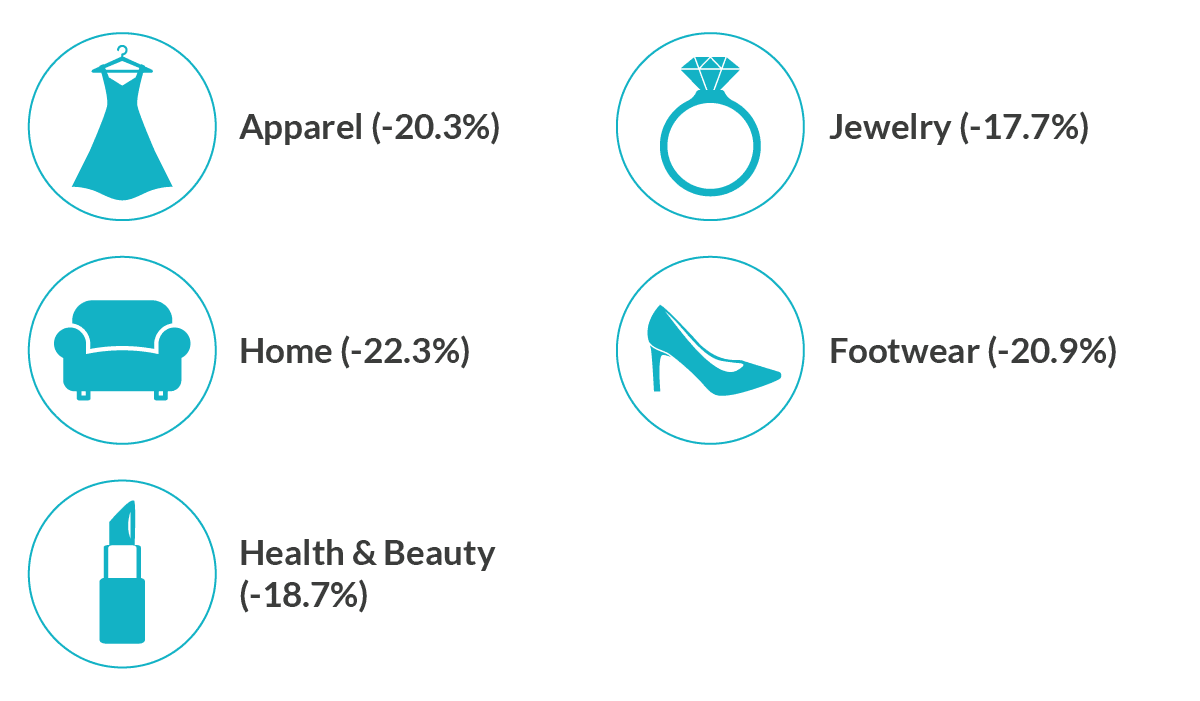

These three trends are in line with the current RetailNext Performance Pulse Report August 2021.

READ MORE: Performance Pulse August 2021

6 Holiday Season Tips For Physical Stores

To maximize these opportunities ahead of Black Friday, Thanksgiving Day, and the festive season as a whole, retailers and other venue operators must have their fingers on the pulse of consumer behavior and align their holiday strategies with these emerging trends. Comprehensive analysis of traffic, with multiple data points available on what’s happening in stores, can be the key to unlocking these opportunities and optimizing shopper yield by understanding the full picture.

READ MORE: Digital KPI’S IRL: E-Commerce Metrics For Brick-And-Mortar

Tip 1: Effective Staff Scheduling - The widespread labor shortage is set to persist for some time, underpinning the need for retailers to optimize scheduling for their existing staff. Your traffic data should provide predictive shopper traffic trends to forecast peak hours and shopping behavior patterns. Analysis of this will help to schedule store associates and shoppers per labor hour to traffic power hours, by integrating workforce management with traffic data. You’ll be able to add staff when needed and remove staff when traffic is low yet conversion remains stable.

By quantifying where shoppers are spending most of their time in-store, you can also ensure that store associates are placed in the right areas of the store. If store associates are spending more of their time in Shoes, while the shopper is spending more time in Apparel, consider adding a floater in Shoes to monitor Apparel as needed.

BONUS TIP: Optimizing labor per traffic hours will also allow stores to play out their day and week. It gives retailers the ability to factor in non-selling activities, such as order fulfillment, which are just as important to productivity and generating customer traffic. With increased delays to shipping, efficient alternative delivery methods, like BOPIS and BOPAC, will be key to fulfilling orders on time. By reviewing traffic data with AI predictions, brick-and-mortar stores are able to determine how long it takes to fulfill orders, and how many associates are needed.

READ MORE: How To Handle Labor Shortage Challenges Using Real-Time Data

Tip 2: Empower Stores To Improve Performance - Key performance metrics — such as conversion rates — can be revealed across all stores, in real-time by integrating traffic data with your in-store POS feeds and staffing data. This enables corporate teams to provide constant and timely feedback to store managers while opening the door to a more data-driven performance culture. In turn, stores will also be empowered to course-correct by viewing their performance, benchmarked against established KPIs and other stores.

Tip 3: Improve Displays And In-Store Initiatives - 80% of marketers are focusing their efforts on the physical store this holiday season (Sitecore’s Holiday Season Trends Report 2021). Make sure your marketing team is equipped with rich traffic data to identify which marketing levers to pull that will drive the efficacy of their campaigns. If store traffic is too low, marketing teams can look at potentially increasing the frequency of email blasts and advertising to drive awareness. Marketers can also gain a better understanding of whether customers are entering because of the vibrant windows displays, or other activations, by analyzing the stores’ capture rate.

BONUS TIP: Keep an eye on the engagement rates for entrance fixtures to understand if they’re too close to the entrance. While they may attract a lot of traffic, retailers run the risk of customers missing it because it's in the decompression zone. Reviewing your in-store traffic data will help determine if entrance fixtures need to be pulled further back or perhaps review the visual merchandising to ensure it catches shoppers' eyes as they walk in.

Tip 4: Increase Agility With Category Management - The ability to change course with increased speed and accuracy will better enable retailers to negotiate the impact of the supply chain crunch and other marketplace dynamics. With limited assortments and products available, analyzing traffic trends in real-time can help brick-and-mortars better understand product placement (product visibility vs customer demand). This provides the opportunity to adjust merchandising if needed, in order to drive conversion with the inventory they have on hand and still achieve their targets.

BONUS TIP: If you’re trying to understand why a category is underperforming, investigate the dwell and dwell conversion rate. If shoppers dwell most at the category, while dwell CVR remains low, this confirms the challenge is not with engagement but rather with converting. Consider focusing on assortment and inventory versus marketing assets or merchandising.

Tip 5: Enable Virtual Queuing - Creating a seamless and blended in-store experience is key for retailers this holiday season as customers' expectation, for a more digital experience in physical locations, continues to grow. A great way to achieve this is by integrating in-store traffic data with a virtual queuing app such as YOOBIC. Through its partnership with RetailNext, many brick-and-mortar stores are able to enhance their in-store experience and reduce high-density occupancy levels by enabling customers to:

check live in-store occupancy levels at any location

select the store location where they’d prefer to shop

join the virtual waiting list or book an appointment

get a notification when it's their turn

Tip 6: Asset Protection - With more traffic expected in stores this holiday season, the increased activity also presents a need for enhanced security measures. Traffic solutions with video and analytics features are extremely useful for asset protection. AP teams should be able to easily search for specific transactions and view or export both receipt and video. By narrowing down transactions of interest according to the date, store ID, payment type, etc, you can leverage shopper-presence video analytics to quickly zero in on potential fraud.

Let’s Wrap Up...

For physical locations, like brick-and-mortar retailers, c-stores, and direct-to-consumer brands, to achieve performance gains during the holiday season, they must:

understand how to use these overarching upward trends to optimize

ensure that subsequent strategic decisions are based on data-driven insights

Before businesses haul out costly initiatives - such as mass sales and marketing campaigns, recruitment drives for seasonal staff, discounts and promotions, assortment planning, and revised store layouts - they must be confident these business models are founded on accurate, verifiable, and actionable store traffic data.

About the author:

Judith Subban, Marketing Communications Manager, RetailNext