The Pulse: NRF 2025 Day Three, 14 January Recap

The final day of the annual NRF Big Show did not disappoint. The show finished strong with insightful keynote addresses, invaluable networking opportunities, and that signature New York razzle-dazzle. Here’s what you may have missed today at the show.

READ MORE: 2025 Retail Trends That Are Changing The Game

Keynote Callout: Global Economic Outlook

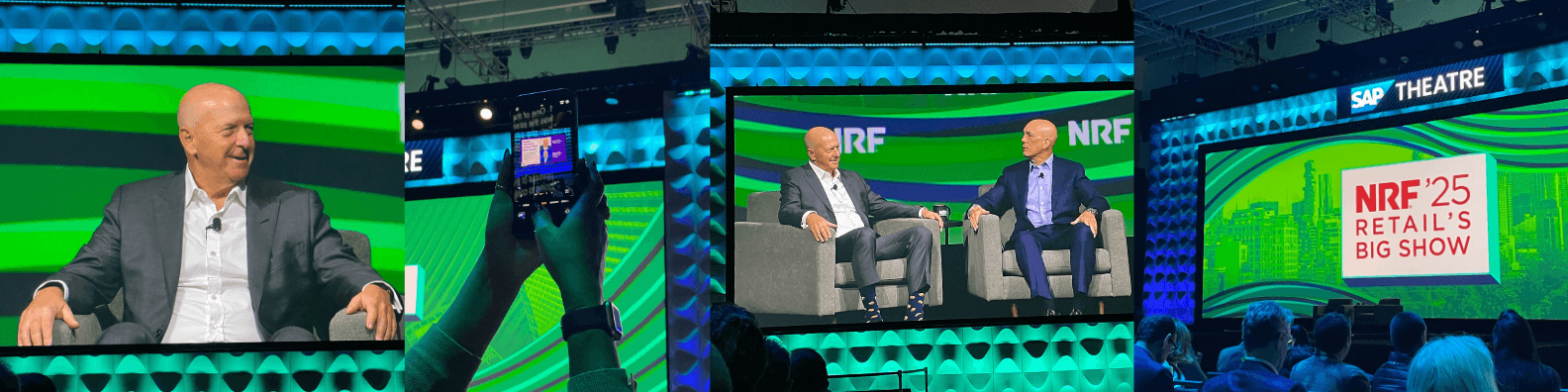

The NRF Big Show keynote session, "Global Economic Outlook 2025 and Beyond: A Conversation with Goldman Sachs Chairman and CEO," offered an insightful look into the economic landscape for the upcoming years. Moderated by Matthew Shay, President and CEO of the National Retail Federation, the discussion delved into various factors influencing both the global and U.S. economies, providing a comprehensive overview of potential opportunities and challenges ahead.

David Solomon, Chairman and CEO of The Goldman Sachs Group Inc., began by highlighting the resilience of the U.S. economy despite numerous obstacles. He noted the extraordinary global interest in investing in the U.S., driven by the country's culture of innovation, which serves as a significant tailwind for the local economy. Solomon underscored the fragile nature of this position, citing the fiscal stimulus following the pandemic and the ongoing impact of inflation as key indicators. He emphasized that the U.S. cannot sustain its previous levels of spending indefinitely, hinting at a likely shift towards tighter economic policies under the new administration. Deregulation, he suggested, could act as a catalyst for further investment.

Shay contributed to the discussion with his vivid analogy of the "bodybuilder consumer," referring to the current state of high consumption levels paired with minimal reserves. He described inflation as extraordinarily punitive, stressing the need for immigration to sustain labor growth and, consequently, economic expansion. Shay referenced a recent jobs report that had a negative impact on market sentiment, reflecting broader concerns about employment and debt management. He warned of persistent inflationary pressures, indicating that these issues could remain on the horizon for some time.

Looking ahead, Solomon expressed uncertainty about the trajectory of central bank policies, likening speculation on rate adjustments to a "parlor game." He emphasized the data-sensitive nature of the federal structure, which takes decisions one meeting at a time. Despite this uncertainty, he pointed to positive developments under the new administration, including increased deregulation, which he viewed as conducive to growth and investment. Solomon also highlighted the importance of achieving a balanced approach to immigration to ensure job growth and economic stimulation.

Beyond the U.S., Solomon identified significant opportunities on the global stage. He argued against de-globalization, advocating instead for a more strategic approach to supply chains and resources. He predicted a trend towards localization in manufacturing and supply chains, emphasizing the need for diversification and security. Solomon stressed that while rethinking global capital flows is necessary, such changes will take time to implement effectively.

The discussion also touched on the transformative potential of artificial intelligence (AI). Solomon highlighted the rapid advancements in large language models and computing speed, which have made AI tools accessible to the general public. He noted that while major corporations have long utilized AI and machine learning, these technologies are now poised to enhance productivity significantly, with an expected 1.5% improvement compounded over the next decade. However, Solomon cautioned that the impact of these tools might be "overstated in the near-term and understated in the long-term," emphasizing the challenges and time required to adapt to such changes.

The session provided a thorough examination of the economic outlook for 2025 and beyond. Both Solomon and Shay offered valuable insights into the dynamics shaping the global and U.S. economies, highlighting key areas of focus such as inflation, deregulation, global opportunities, and the transformative potential of AI. As the retail industry navigates these evolving landscapes, the perspectives shared during this session will undoubtedly serve as a guiding light for strategic planning and investment decisions.

READ MORE: 2024 Retail Trends Worth Having On Your Radar

The Pulse: Adore Me's Game-Changer Strategy

We hosted Adore Me in the final installment of The Pulse, our dedicated NRF thought leadership program. Marie-Prune de Batz, Performance Marketing & Merchandising Director at Adore Me, and Joe Shasteen, Global Manager of Advanced Analytics at RetailNext, shared the innovative journey of Adore Me’s retail expansion and data-driven strategy.

Bridging E-commerce and Physical Retail

When Adore Me ventured into brick-and-mortar retail in 2018, they aimed to replicate the e-commerce funnel in physical stores. The goal was to track and understand traffic and conversion rates in the same way they did online. This data-driven approach was revolutionary for a digitally-native brand.

With over four years of historical data now at their disposal, Adore Me uses these insights to optimize various aspects of their operations. One key area is labor planning—a new challenge for the brand as they navigated the complexities of physical retail. Additionally, traffic data has become integral to their replenishment processes, ensuring a seamless link between customer purchases and inventory restocking.

Driving Traffic and Conversion in Physical Stores

Adore Me has identified several main drivers for in-store traffic:

High-promotional periods, especially around occasions like Valentine’s Day.

Store-specific promotions designed to entice customers into physical locations.

Special events such as influencer gatherings and bridal showers.

Interestingly, customer behavior varies significantly between online and in-store experiences. Conversion rates are markedly higher in stores, where the tactile experience and curated displays encourage customers to make more substantial purchases. In-store shopping also presents greater opportunities for upselling, as customers can see and feel the products, often opting for matching sets when shopping for lingerie.

Adapting to Post-Pandemic Retail Trends

The post-pandemic period saw a surge in in-store traffic, driven by the resurgence of social events like weddings. However, since 2022, Adore Me has observed a double-digit decrease in traffic, prompting the need for forward-thinking strategies. Despite this, the brand remains hopeful, focusing on the human element of their stores to enhance customer relationships.

In-store experiences are designed to go beyond mere transactions. Services such as bra measurements create meaningful interactions, fostering loyalty and ensuring customers leave with products tailored to their needs. This commitment to customer experience is reflected in Adore Me’s impressive Net Promoter Score (NPS), which consistently remains above 90.

Personalized Customer Engagement

Adore Me emphasizes one-on-one connections with their top customers. Each store maintains a list of its top 50 customers, who receive exclusive invitations to events, early access to new collections, and personalized discounts. This high-touch approach underscores the brand's dedication to building lasting relationships.

Embracing Technology with a Human Touch

The integration of advanced tools like 3D body scanning enhances the fitting experience, offering precise measurements. However, Adore Me recognizes that the human touch remains crucial. Associates are trained to guide customers through these technological advancements, ensuring a supportive and confidence-building experience.

Sustainability at the Core

Sustainability is a fundamental pillar for Adore Me. Store associates are well-versed in sustainable practices, and initiatives like the bra recycling program—where customers can return used bras for discounts—highlight the brand’s commitment to environmental responsibility.

Looking Ahead: 2025 and Beyond

Adore Me’s 2025 focus is on creating more experiential retail spaces, especially in malls. The goal is to craft memorable experiences that resonate with customers, blending the digital and physical worlds into a cohesive and engaging retail journey.

In summary, Adore Me’s game-changing strategy seamlessly integrates data-driven insights, personalized customer engagement, and a strong commitment to sustainability. Their innovative approach not only enhances the in-store experience but also sets a benchmark for the future of retail.

We would like to sincerely thank those who came by our booth and supported us. It was a pleasure connecting with you and charting a course for the future of retail together. We look forward to kicking things up a notch in 2025!

Thank you to our partners, Fusion Analytics, Zipline, and Legion Technologies, for their vibrant presence at our booth and off-site events.

Here’s to the year ahead!

READ THE eBOOK: Retail 2.0: The AI Advantage

About the author:

Ashton Kirsten, Global Brand Manager, RetailNext

Ashton holds a Master's Degree in English and is passionate about physical retail's unbridled potential to excite, entertain, serve, and solve problems for today's shoppers.