Beauty Retail Remains Resilient Despite Spending Squeeze

On this page

The beauty category (namely skincare, fragrance, makeup, and haircare) has continued to thrive despite inflation, rising living costs, and economic uncertainties. While other categories, like homeware, jewelry, and footwear, may experience fluctuations in consumer spending during economic downturns, beauty retail has proven remarkably resilient.

In fact, McKinsey research indicates that the beauty market is expected to reach approximately $580 billion by 2027, growing by a projected 6% a year. What’s more, beauty is expected to be characterized by “premiumization,” with the premium beauty tier projected to grow at an annual rate of 8% (compared with 5% in mass beauty) between 2022 and 2027 as consumers trade up and increase their spending, especially in fragrance and makeup. Amidst widespread financial difficulties, beauty brands have rebranded themselves as a form of self-care.

READ MORE: Retail Reinvention: How 3 Legacy Brands Stay Relevant Today

The Beauty Of Self-Care In Turbulent Times

At the heart of the beauty industry's resilience lies a fundamental human need: the desire for self-care and personal well-being. Amidst economic uncertainties and daily stressors, individuals seek solace and self-expression through beauty rituals. From skincare routines to makeup application, these practices serve as forms of self-care, allowing individuals to nurture themselves amidst the chaos.

The COVID-19 pandemic further accentuated the importance of self-care. With lockdowns and social distancing measures in place, people turned to skincare and beauty routines to self-soothe and maintain a sense of normalcy. According to a report by McKinsey & Company, the global beauty industry witnessed a surge in demand for skincare and wellness products during the pandemic, reflecting the growing emphasis on self-care in turbulent times.

Furthermore, the rise of social media and digital platforms has democratized beauty, empowering individuals to explore and experiment with different products and trends. Influencers and beauty bloggers share personal anecdotes and product recommendations, fostering a sense of community and camaraderie among beauty enthusiasts. As a result, the beauty industry has become more inclusive and accessible, catering to a diverse range of preferences and identities.

The Power Of Innovation And Adaptability

Another key factor driving the resilience of beauty retail is the industry's relentless focus on innovation and adaptability. Beauty brands continuously introduce new products, formulations, and technologies in response to changing consumer needs and preferences, keeping consumers engaged and excited.

For instance, the rise of clean beauty and sustainability has prompted many brands to reformulate their products and adopt eco-friendly practices. Consumers, particularly millennials and Gen Z, are increasingly conscious of the ingredients they put on their skin and the environmental impact of their beauty choices. As a result, brands that prioritize transparency and sustainability are gaining traction in the market.

Moreover, technological advancements, such as augmented reality (AR) and artificial intelligence (AI), are reshaping the beauty retail landscape. Virtual try-on tools, like Sephora’s Virtual Artist, allow consumers to experiment with different makeup looks and shades before purchasing, enhancing the online shopping experience. Similarly, personalized beauty recommendations based on AI algorithms enable brands to deliver tailored solutions to individual consumers, fostering loyalty and satisfaction.

READ MORE: Retail Impact: Europe’s Move Towards Sustainable Fashion

Economic Resilience Through Affordability

Beauty retail remains resilient despite inflation and rising costs due to its inherent affordability and accessibility. Unlike luxury goods or discretionary spending categories, most beauty products are often perceived as essential items, integral to daily grooming and hygiene routines. As a result, consumers are willing to prioritize spending on beauty products, even during periods of economic uncertainty. For example, the Financial Post recently reported that young shoppers find there’s “Always a reason to buy beauty.”

The article continues, " The impulse to dive into a beauty regimen has come from the endless scroll of social media posts showing influencers slathering on Drunk Elephant skincare products, reaching for Dior’s lip oil, and swearing by Sol de Janeiro’s Brazilian Bum Bum cream.” During times of recession, people tend to have less money to spend. However, the popularity of certain viral products shows that customers are still willing to splurge on a small item, such as a lipstick. This phenomenon is known as "the lipstick effect" and was coined by Leonard Lauder, who is an heir to the Estee Lauder cosmetics empire.

Furthermore, the democratization of beauty has led to the proliferation of affordable options across all product categories. From drugstore staples to indie brands, consumers have a plethora of choices at various price points, allowing them to indulge in their beauty rituals without breaking the bank. This affordability factor has proven to be a lifeline for many consumers, especially during times of financial strain.

Looking Ahead: Beauty By The Numbers

While the beauty industry has demonstrated remarkable resilience in the face of economic turbulence, challenges remain on the horizon. Inflationary pressures, supply chain disruptions, and shifting consumer preferences continue to pose challenges for beauty brands and retailers alike. However, by staying attuned to evolving consumer needs and leveraging innovation and adaptability, the beauty industry is well-positioned to weather these challenges and emerge stronger than ever before.

Moreover, amidst the uncertainty lies a wealth of opportunities for growth and expansion. As consumers increasingly prioritize health and wellness, the demand for clean beauty and wellness products is expected to soar. Similarly, the rise of digitalization and e-commerce presents avenues for brands to engage with consumers in new and innovative ways, from virtual consultations to interactive shopping experiences.

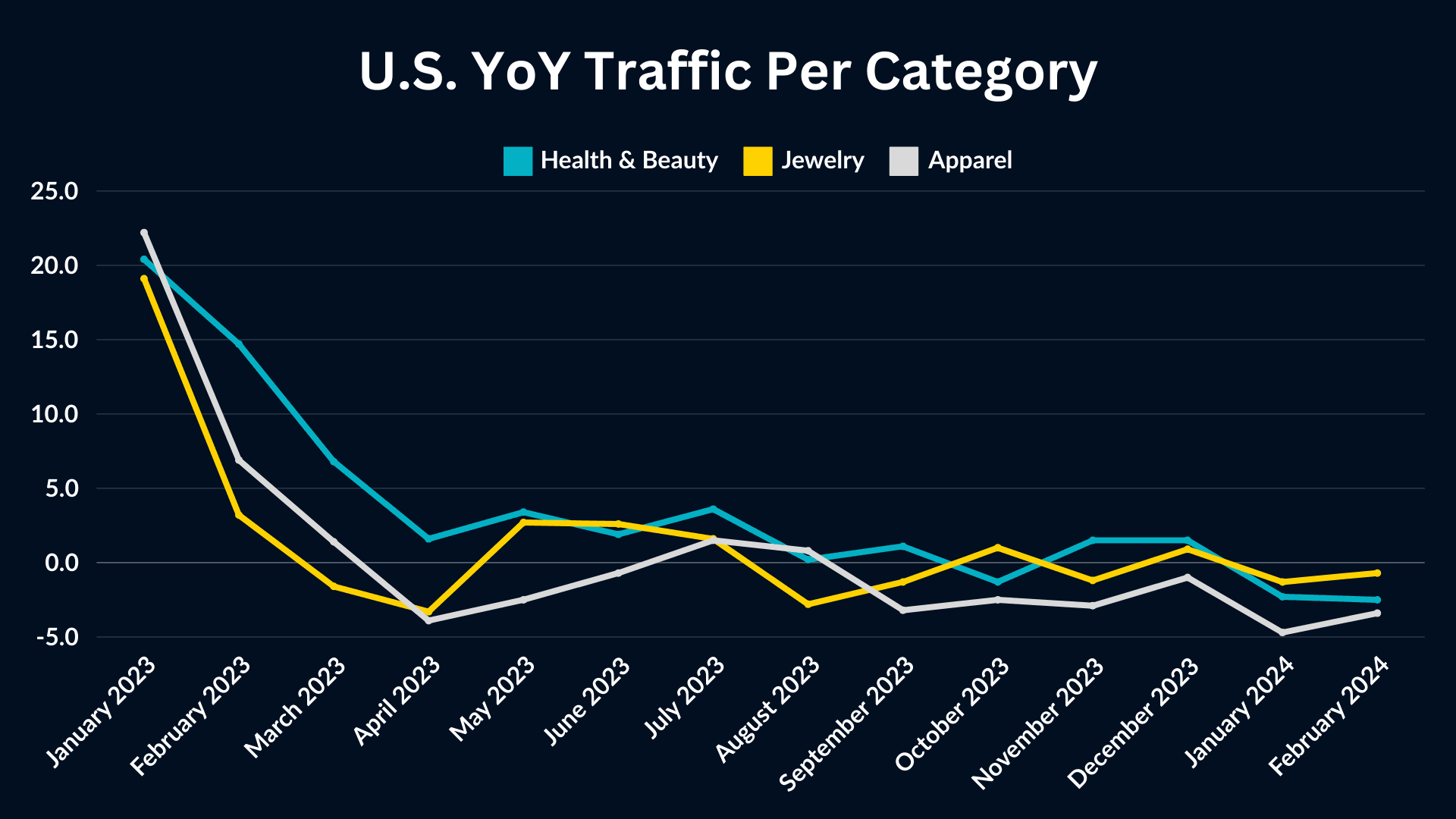

For illustrative purposes, the traffic in the health and beauty category is compared with the traffic in the jewelry and apparel category in the United States. Health and beauty is the most consistent category, boasting mostly positive YoY growth after a hearty post-pandemic store boom in December 2022.

The resilience of beauty retail amidst inflation, cost of living pressures, and macroeconomic uncertainties can be attributed to a combination of factors, including the enduring appeal of self-care, innovation and adaptability, and affordability and accessibility. As the beauty industry continues to evolve and adapt to changing market dynamics, it remains a beacon of hope and inspiration in an ever-turbulent economy.

About the author:

Ashton Kirsten, Global Brand Manager, RetailNext

Ashton holds a Master's Degree in English and is passionate about physical retail's unbridled potential to excite, entertain, serve, and solve problems for today's shoppers.