Taking A Pulse On Rising Retail Crime

On this page

The dark cloud of retail crime hangs heavy over 2023. It is imperative to take a closer look at the current state of retail crime, understand its evolving dynamics, and provide strategies for physical retailers to mitigate this issue. In this blog, we will delve into the statistics of retail crime in 2023, explore possible explanations for its growth since 2020, and offer actionable strategies that retailers can implement to safeguard their businesses and customers.

Retail leaders have taken to citing retail crime and shrink as a key issue in their earnings presentations. Target, Walmart, TJX, Foot Locker, Dick's Sporting Goods, Dollar General, and Ross Stores all pointed to the growing challenge of theft-related shrink in their most recent earnings calls. The reality is that crime is seriously impacting retailers’ bottom lines. Target, for example, expects to take a $500 million hit to its profitability due to retail theft this year, up 25% from $400 million last year.

In the US, at least nine states – six so far this year – have passed laws to impose harsher penalties for organized retail crime offenses since 2022. Similar bills are pending before legislatures across the country and in the U.S. Senate after retailers threaten to close their doors. In an interview with CNBC, Walmart’s CEO, Doug McMillon, warned that if retail crime is not addressed, over time “prices will be higher, and/or stores will close”. Similarly, retail businesses in the UK are also considering the commercial viability of stores in certain areas as a result of a sharp increase in criminality.

Across the pond, UK retailers are finding themselves combatting a “shoplifting epidemic”. In fact, the British Retail Consortium has found that shop thefts have more than doubled in the past three years, amounting to nearly a billion Pounds lost to customer theft. In March 2023, police forces in England, Wales, and Northern Ireland recorded nearly 33,000 incidents of shoplifting – a staggering 30.9% YoY increase. This trend mirrors the situation in the US, with the NRF, reporting that the majority of consumers (53%) believe retail crimes like shoplifting have increased in their communities since the pandemic.

READ MORE: The Future Of Retail Starts With A New Approach To Shrink

Retail Crime By The Numbers

Retail crime has been a persistent problem in the industry, but the statistics for 2023 are particularly concerning. According to the National Retail Federation's 2022 National Retail Security Survey, US retailers lost an estimated $94.5 billion to shrink in 2021 alone. This report also found that 70% of retailers believe ORC (organized retail crime) has become a more prevalent threat over the last five years. This sends a clear signal that retail crime is on the rise.

One alarming trend is the increase in violent incidents during retail thefts. This includes confrontations between employees and thieves, as well as altercations involving innocent customers caught in the crossfire. The NRF’s Security Survey found that eight in 10 retailers reported an increase in violence against employees in 2021. The report also points to a case where one retail employee has recounted facing 22 robberies within a two-day window.

Moreover, organized retail crime (ORC) or “external theft” has become more sophisticated and widespread. These criminal groups are responsible for a substantial portion of retail thefts, often targeting high-value merchandise. But what do we mean when we say “organized retail crime”? In a recent episode of The Indicator by Planet Money, it was defined as a large-scale theft operation conducted by a group of two or more individuals. This group may do smash and grabs, shoplift off shelves, or steal large numbers of products from stores, and then try to resell them online. The sheer scale and coordination of these operations make them a formidable challenge for retailers.

Exploring Potential Explanations For Retail Crime

To understand the surge in retail crime since 2020, we must consider several key factors that have contributed to this unsettling trend. The pandemic shook things up and its effects still loom large.

Economic Hardships: The economic fallout from the COVID-19 pandemic has left many individuals financially strained. Job losses and reduced incomes have pushed some people towards theft as a means of survival, while others may view retail crime as a quick way to acquire goods they can no longer afford.

Supply Chain Disruptions: The disruptions in supply chains caused by the pandemic have led to shortages of certain products. When consumers cannot find these items on store shelves, it can incentivize theft, especially if these products are in high demand.

The Labor Shortage Persists: Store staff have their hands full as brands struggle to attract and retain retail staff. In summary, Fortune reports that “nobody is winning” as customers want longer opening hours, stores aren’t able to fill positions, and employees feel overworked.

Technologically Advanced Criminal Tactics: Criminals have become increasingly tech-savvy, utilizing tools like electronic card skimmers, counterfeit currency, and online marketplaces for stolen goods.

READ MORE: How To Protect Store Staff From The Fallout Of Retail Crime

Future-Forward Asset Protection

While the challenges posed by retail crime in 2023 are significant, there are proactive strategies that physical retailers can adopt to protect their businesses and customers.

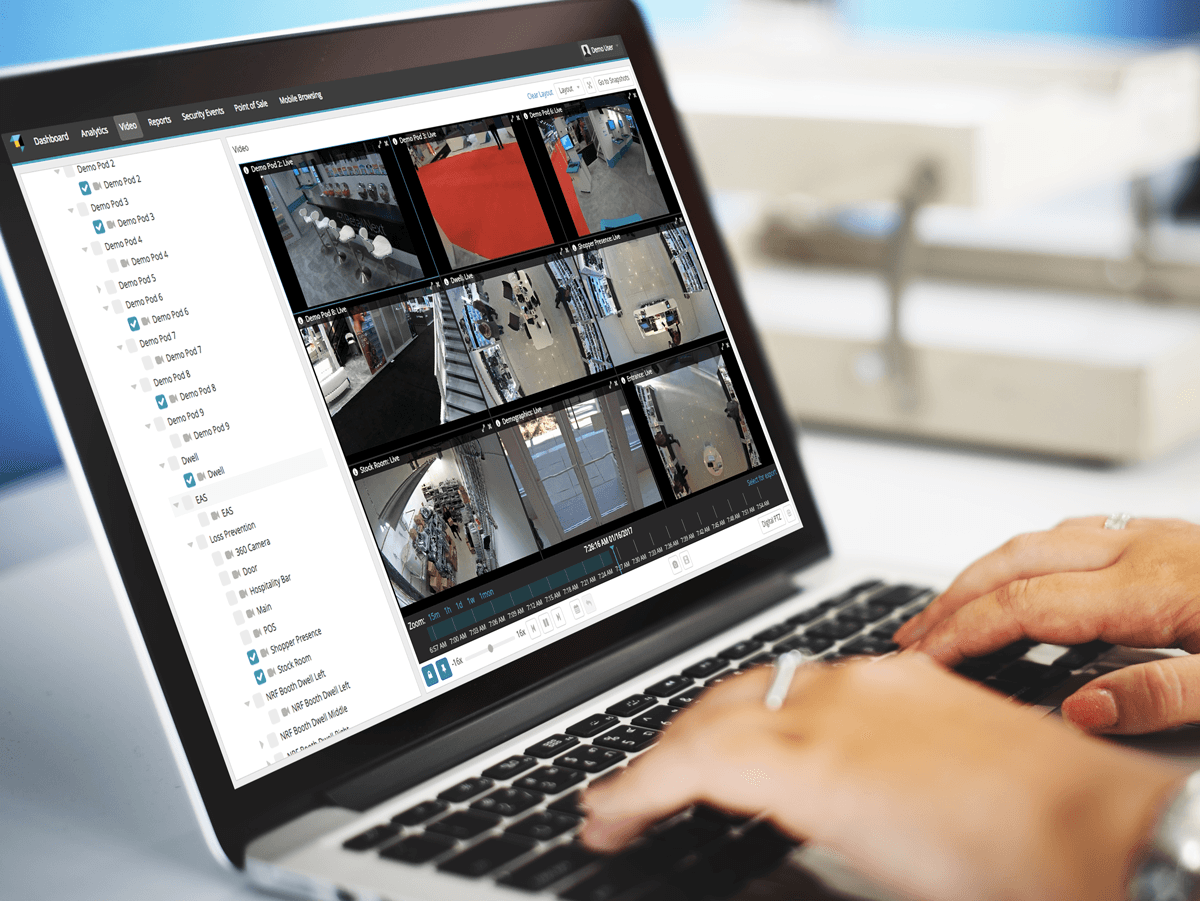

In-store Analytics

First and foremost, investment in in-store analytics is key. Store data can help identify high-risk areas and patterns of theft. Plus, the deployment of advanced surveillance technology, including AI-powered cameras, is a leading criminal deterrent. This technology also facilitates remote investigations, helping retail businesses cut investigation time by 75% and save money in the process.

Store Staff Empowerment

Employee training and awareness are of equal importance. Train employees to recognize and respond to potential theft situations so that they are empowered to protect themselves in times of threat. Encourage a culture of vigilance and provide them with the tools to report suspicious activity discreetly, monitor remotely, and intervene responsibly. Retailers who ignore the well-being and training of their staff run the risk of exacerbating the labor shortage with ongoing and far-reaching financial consequences.

Merchandise Security

While perhaps not entirely easy on the eyes, merchandise security measures have become a key part of retailers’ arsenal. It is now relatively commonplace for retailers to employ anti-theft measures such as locked display cases, electronic article surveillance (EAS) systems, and RFID tags on high-value items. These measures make it difficult for thieves to access and steal merchandise. For example, Best Buy has removed high-value, easy-to-pocket items from shelves, replacing them with laminated QR codes. Shoppers scan the codes of items they wish to see and customer service staff will bring the goods out to them. While this may impact the overall customer experience for now, brands can get creative by deploying virtual try-on experiences to align with customer expectations while also securing their safety.

Robust Return Policies

Implementing clear and consistent return policies minimizes fraudulent returns. Stores should require proof of purchase and use technology to track and detect suspicious return patterns. Fraud should not be discounted in discussions about retail crime. For example, in recent weeks, a Connecticut man was given nearly $300,000 in fraudulent Home Depot credit by walking into stores in several states, taking expensive doors, and then returning them without a receipt. Retailers looking to employ a seamless returns process will need to strike a balance between customer convenience and fraud prevention.

Retail crime in 2023 presents a daunting challenge for physical retailers, but it is not insurmountable. By understanding the underlying factors driving this trend and implementing effective strategies, retailers can safeguard their businesses, protect their customers, and champion the resilience of brick-and-mortar retail.

About the author:

Ashton Kirsten, Global Brand Manager, RetailNext

Ashton holds a Master's Degree in English and is passionate about physical retail's unbridled potential to excite, entertain, serve, and solve problems for today's shoppers.