It's Spooky Season: 2023 Halloween Retail Trends

On this page

As we step into the crisp embrace of October, the world begins its annual transformation into a realm of pumpkin-spiced delights, eerie decorations, and the compelling promise of Halloween. This season marks a significant occasion in the retail calendar. Halloween may conjure images of ghosts and ghouls, but for retail industry decision-makers and champions, it's all about deciphering what will enchant consumers into their physical stores.

In an age where e-commerce has been on the rise, physical retailers are reimagining their spaces to offer immersive experiences. Halloween, with its inherent potential for transformation and creativity, is a perfect occasion for this. Retailers like Spirit Halloween have mastered the art of turning ordinary spaces into haunted wonderlands. Their pop-up stores, often found in vacant retail spaces, are known for their elaborate, spooky setups that draw in crowds. However, as the cost of living continues to be a pain point, the question lingers: Will this Halloween be a spooktacular occasion for seasonal shopping or will retailers’ spirits be down?

This blog delves into 2023’s Halloween shopping trends, offering insights and data-driven analysis. We'll explore how this spooktacular holiday impacts brick-and-mortar retail and the incredible power of in-store analytics in harnessing its full potential. Join us on this journey through the cobweb-covered aisles of Halloween retail, where data and innovation intertwine to create a retail experience like no other.

READ MORE: Apps, Media, & Monetization: Integrating Mobile Commerce

Will Shoppers Spend Less This Halloween?

PowerReviews’ 2023 Halloween Spending Trends report surveyed 18,906 US consumers in August 2023. The report shows many shoppers are tightening the reins on their Halloween spending this year. According to the report

73% of respondents say economic challenges will impact their Halloween shopping;

24% will be reusing/recycling existing costumes;

34% will be buying cheaper Halloween candy;

34% say they’ll forgo buying Halloween decorations this year;

44% say they will be looking for bargains/using coupons for Halloween items.

However, the National Retail Federation’s (NRF) annual Halloween consumer survey revealed that total Halloween spending in 2023 was expected to reach a record $12.2 billion, exceeding the previous year’s record of $10.6 billion. Hearteningly, this survey reports that Halloween participation is expected to return to pre-pandemic levels this year! A bewitching 73% of respondents plan to celebrate the occasion with $108.24 planned spending per person. This should result in total spending of around $12.2B across the US.

“More Americans than ever will be reaching into their wallets and spending a record amount of money to celebrate Halloween this year,” NRF President and CEO Matthew Shay said. “Consumers will be shopping early for festive décor and other related items and retailers are prepared with the inventory to help customers and their families take part in this popular and fun tradition.”

Categories Creepin’ It Real

The NRF reports that a record number of people (73%) will participate in Halloween-related activities this year, up from 69% in 2022. So, what will celebrants be spending their hard-earned money on?

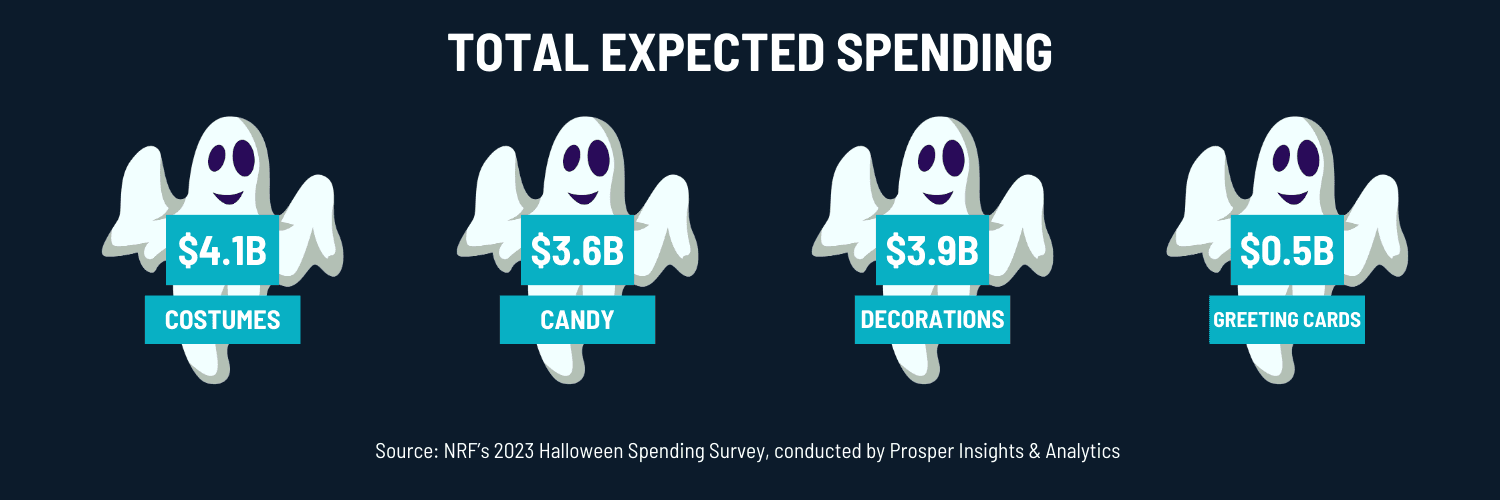

69% of those celebrating Halloween plan to buy costumes, up from 67% last year and the highest in the survey’s history. Total spending on costumes is expected to reach a record $4.1 billion, up from $3.6 billion in 2022.

Total spending on decorations, which grew in popularity during the pandemic and continues to resonate with consumers, is expected to reach $3.9 billion. Of those celebrating Halloween, more than three-quarters (77%) plan to purchase decorations, which is on par with last year, but up from 72% in 2019.

Candy spending is expected to reach $3.6 billion, up from $3.1 billion last year. Spending on Halloween greeting cards is projected to be $500 million, down slightly from $600 million in 2022 but above pre-pandemic levels.

READ MORE: How Advanced Analytics Empower Multi-Brand Retail

Why Store Data Matters

In-store analytics play a pivotal role in maximizing Halloween sales. Retailers are using technology to track foot traffic and customer behavior within their stores during the Halloween season. They're leveraging heat maps, RFID technologies, and cameras to gain insights into which sections of the store attract the most attention and where customers tend to dwell.

This data informs decisions about product placement, signage, and even staffing. For example, if analytics show that the costume section gets the most traffic during a certain time of day, retailers can deploy more staff there to assist customers, improving the shopping experience.

Advanced analytics also empower accurate personalization of the shopping experience (which is increasingly becoming the expectation of customers). Retailers must harness data to understand consumer preferences and tailor their Halloween offerings accordingly. For instance, a store might analyze purchase history and use AI algorithms to recommend Halloween costumes that match a customer's previous choices or interests.

Scary Good In-Store Experiences

Home Depot, known for its hardware and home improvement products, has recognized the growing trend of DIY Halloween decorations and costumes. The hardware giant takes pains to design creepy, immersive in-store experiences with massive animatronics displays. Along with Halloween Classics, this year’s theming includes the haunted bayou of Dead Water, and the cemetery-inspired Grave and Bones. These towering animatronics displays, paired with their popular in-store DIY craft workshops, boost foot traffic but also position Home Depot as the go-to destination for DIY Halloween enthusiasts, leveraging their core product offerings in a creative and engaging way.

Michaels, the chain of American and Canadian arts and crafts stores, gets ahead of the game by displaying Halloween merchandise as early as July! Uniquely, Michaels also dedicates various sections to their Halloween stock, dividing it into aesthetics. For example, this year’s Halloween collections include the bright and classic Electric Halloween, the pastel-colored palette of Sweet & Spooky, the Gothic floral designs of Wicked Garden, and the enchanting Witches Lair. Plus, stores offer gradually increasing discounts in the run-up to the occasion, incentivizing price-sensitive shoppers to visit stores.

From mid-September, Target becomes a one-stop shop for consumers’ All Hallow’s Eve needs. Known for its distinctive Hyde and Eek line, Target has been known to create "Halloween boutiques" within its stores, featuring curated selections of Halloween-themed food, home decor, and even beauty products. This diversification of Halloween offerings can attract a broader range of shoppers who might not be interested in costumes but want to participate in the holiday spirit. Moreover, the brand has also differentiated itself by foregrounding accessibility. Its adaptive Halloween costumes cater to a variety of special needs for both adults and children. Launched in 2019, the designs are meant to adapt to wearers’ mobility or sensory needs. This inclusivity is bound to increase ATV (as the whole family is catered for by one store) and breed brand love and positive sentiment from already-devout shoppers.

This Halloween is set to be more delightful than frightful for retailers. Shoppers are enthusiastically returning to stores and spending at record highs. Retailers who deliver exciting in-store experiences, deliver data-driven personalization, and make shopping easy, diverse, and cost-effective are bound to conjure success.

READ MORE: Understanding ‘Hyperphysical’ Luxury Retail

About the author:

Ashton Kirsten, Global Brand Manager, RetailNext

Ashton holds a Master's Degree in English and is passionate about physical retail's unbridled potential to excite, entertain, serve, and solve problems for today's shoppers.